Every year, Market Watch and sister publication Impact Newsletter highlight the fastest growing smaller brands throughout the wine and spirits industry with the “Hot Prospects” awards, spotlighting the up-and-coming players poised to become significant growth drivers in the years ahead. This year, a total of 64 brands from the wine, spirits, and RTD cocktail categories met Impact Databank’s criteria to earn honors. To qualify as Hot Prospects, brands must have achieved at least 15% depletions growth for 2024, while also showing consistent growth in the two preceding years. For spirits and imported wines, brand volumes must be between 50,000 and 200,000 cases, while domestic wine and RTD volumes must be between 50,000 and 250,000 cases.

Agave Makes Its Mark

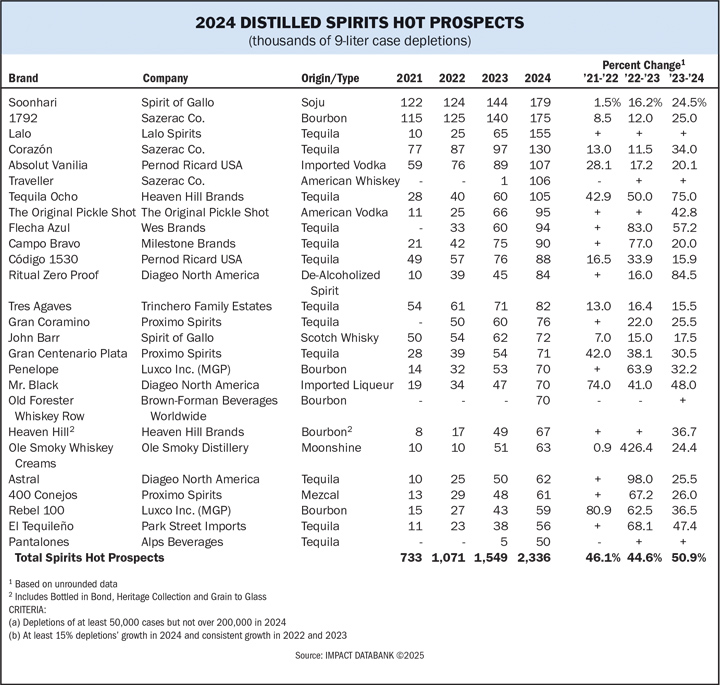

This year, 26 spirits brands earned Impact Hot Prospects honors. With 15 new winners for 2024, this year’s class of Hot Prospects shows that despite the wider industry facing headwinds, there are still categories, price points, and occasions that generate consumer excitement. Agave spirits lead the way among 2024 winners, with fully half of the list—12 Tequilas and one mezcal—imported from south of the border.

Whiskey is also holding its own, with eight winners spread across Bourbon, American whiskey, Scotch, and moonshine. Vodka notched two winners for 2024, with liqueur, soju, and non-alcoholic spirits each landing one winner. In all, the 2024 Hot Prospects class totals 2.34 million cases, averaging more than 50% growth last year. As recently as 2021, these 26 brands—including some that didn’t exist then—were at only 733,000 cases. The largest Hot Prospect for 2024 is Spirit of Gallo’s Soonhari soju at 179,000 cases. The brand has accelerated rapidly over the last two years, leaping forward 16.2% in 2023 and 24.5% in 2024, with last year’s acceleration driven by Gallo expanding the brand’s distribution footprint. The flavored soju brand comes in nine varieties, ranging from fruity flavors like apple and peach to lychee and yogurt. All varieties are at 12% abv and are sold in 375-ml. bottles. In addition to Soonhari, Spirit of Gallo earned a second Hot Prospect award for blended Scotch John Barr. The brand, a returning Hot Prospect, grew 17.5% to 72,000 cases. Gallo has imported John Barr to the U.S. since 2015, with momentum beginning to build for the blend in 2021 and accelerating in the years since.

In second is Sazerac’s 1792 Bourbon brand at 175,000 cases, earning its first Hot Prospect award. In 2024, the brand bucked the headwinds facing American whiskeys and grew by 25%, building on solid performance in years past. While the brand is led by its flagship Small Batch offering, 1792— like many of Sazerac’s other American whiskey labels—is popular for its limited releases, including Full Proof, Sweet Wheat, Bottled in Bond, and Aged 12 Years. While the flagship retails in the super-premium segment, 1792’s limited releases retail in the lower end of the luxury tier.

The first Tequila—and third largest spirits Hot Prospect—is also one of the most rapidly ascendant brands on the list, exceeding 100% growth for each of the last three years. The brand, Lalo Tequila, reached 155,000 cases last year on roughly 140% growth. In 2021 the brand was at only 10,000 cases. Lalo’s portfolio includes a blanco Tequila at 40% abv and a limited-edition high-proof blanco at 54% abv. The brand’s upswing could continue through 2025 through a combination of existing momentum and the signing a California distribution agreement with Reyes that took effect in late July.

Rounding out the top five largest Hot Prospects are Sazerac’s Corazón Tequila and Pernod Ricard’s Absolut Vanilia. Corazón was up 34% to 130,000 cases last year and posted steady double-digit growth in the two previous years. Pernod’s largest Hot Prospect grew 20% to 107,000 cases last year. While the flagship Absolut has struggled lately, Pernod has found success with flavored offshoots and, especially, spirits-based RTDs (where the company has a Hot Prospect-winning release this year).

Outside of the top five brands, Tequilas dominate the rest of the list. Heaven Hill’s Tequila Ocho grew 75% last year, cracking 100,000 cases. Recently, the brand added a new high-proof reposado to its collection. The 50.5% abv Tequila is distilled from agave grown in Las Raíces and aged for up to six months in what the company calls “overused” American whiskey barrels. For this year, the brand will release 3,095 cases in the U.S., with each bottle carrying a suggested price of $84 a 750-ml.

While the volumes of this year’s winning Hot Prospects Tequila brands behind Tequila Ocho dip below 100,000 cases, the honorees are still showing some of the most dynamic new Tequila brands in the U.S. WES Brands’ Flecha Azul, a returning Hot Prospect, is nearing 100,000 cases. Last year, the brand was up 57.2% to 94,000 cases. If trends continue, Flecha Azul is well on its way to earning an Impact “Hot Brand” award in the next few years.

Hot on Flecha’s heels are Milestone Brands’ Campo Bravo at 90,000 cases and Pernod Ricard’s Código 1530 at 88,000 cases. Both of these brands are also returning Hot Prospect winners that are almost certain to cross the 100,000-case threshold in 2025. At 82,000 cases, up 15.5%, is Trinchero’s Tres Agaves. The brand, also a returning winner, has steadily built its market presence, growing around 15% each year since 2021. “We bought the intellectual property to the Tres Agaves organic Tequila brand during Covid-19. It’s been a great investment for us,” says Tinchero president and CEO Bob Torkelson. “The Tequila business continues to expand. There are ways for us to continue to build that franchise.”

Proximo’s largest Hot Prospect for the year is Gran Coramino at 76,000 cases, up 25.5%. The brand, created in 2022 by comedian Kevin Hart and Cuervo CEO Juan Domingo Beckmann, has bolstered Proximo’s positioning in the higher end of the category. “Gran Coramino continues to stand out in the crowded market through its commitment to quality by owning every step from planting to bottling,” said Lander Otegui, Proximo’s executive vice president of marketing and innovation. “The brand honors traditional practices, thanks to Juan Domingo Beckmann’s 11th-generation leadership in Tequila and the collaboration with Kevin Hart.”

The company’s other Tequila Hot Prospect, Gran Centenario Plata, also plays in the super-premium space. Last year, the brand was up 30.5% to 71,000 cases. “We’re excited for the momentum we’re seeing across the super-premium and ultra-premium tiers of our Tequila portfolio. As Mexico’s top Tequila, we have been working to elevate Gran Centenario’s presence in the U.S., leaning into its authenticity and craftsmanship,” said Otegui. “We’ve seen great interest in the brand and are continuing to invest in awareness and general education for consumers to drink the Tequila Mexicans do.”

Proximo’s final Hot Prospect is the only mezcal brand to earn honors this year, 400 Conejos. Last year, the brand reached 61,000 cases on 26% growth. Rounding out the agave-based Hot Prospects are Diageo’s Astral at 62,000 cases, up 25.5%; Park Street Imports’ El Tequileño at 56,000 cases, up nearly 50%; and Alps Beverages’ Pantalones, co-founded by Matthew and Camila McConaughey. The brand grew tenfold to 50,000 cases last year, with co-founder Andrew Chrisomalis telling Impact, “We’re expecting very strong growth in distribution, thousands of accounts. We’re expecting very significant double-digit depletion growth throughout the country and globally as well.”

While the whiskey category has lost some momentum in recent years, the Hot Prospect-winning brands for this year offer examples of what consumers continue to reach for. Sazerac is represented with Traveller whiskey. The blended whiskey was designed with country musician Chris Stapleton and grew to 106,000 cases in its first full year on the market, depleting only 1,000 cases in 2023.

Another whiskey finding significant recent success is Luxco’s Penelope Bourbon. The brand grew 32.2% to 70,000 cases last year. Using whiskeys sourced from parent company MGP Ingredients, Penelope issues a wide variety of limited releases (in addition to its core offerings) that show off a range of mash bills and barrel finishes. Luxco’s final Hot Prospect for the year is Rebel 100, a wheated Bourbon that grew 36.5% to 59,000 cases. Tied at 70,000 cases with Penelope is Old Forester Whiskey Row, Brown-Forman’s lone Hot Prospect. In its first year as an aligned collection separate from the larger Old Forester brand, Whiskey Row’s growth was explosive.

The final whiskey to earn a Hot Prospect award is a collection of moonshines from Ole Smoky. Last year, the company’s Whiskey Cream releases grew 24.4% to 63,000 cases. While Ole Smoky’s Whiskey Creams are new to the Hot Prospects list, the distillery’s consistent release of innovations ensure its perennial spot on the Hot Prospect roster. Rounding out the list are the second vodka brand, The Original Pickle Shot, at 95,000 cases, up 42.8%; Diageo’s non-alcoholic spirit brand Ritual at 84,000 cases, up 84.5%; and fellow Diageo brand Mr. Black. The imported coffee liqueur

RTDS Notch Ten Honorees

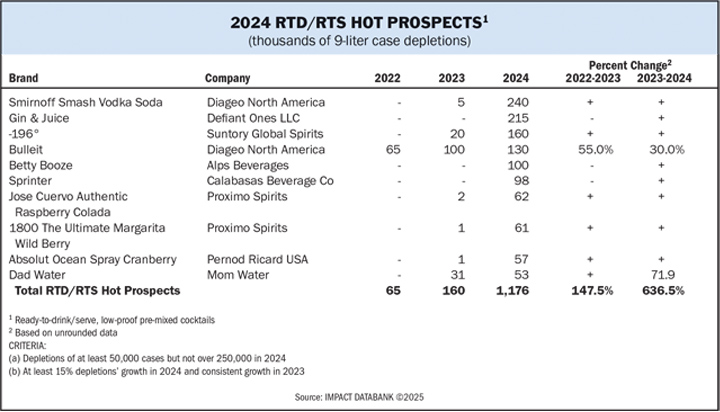

Spirits-based RTDs have posted incredible growth over the last four years, with brands like High Noon rocketing to the top of the market. The number of RTD Hot Prospects has blossomed with a host of brand offshoots and new brands from both established spirits marketers and new players. A Smirnoff offshoot has taken the No.-1 spot in just its second year on the market, followed by a mix of new brands (in the U.S.) like Suntory’s -196, and independent operators like Alps Beverages’ Betty Booze. These Hot Prospect winners total 1.18 million cases, and eight of the ten increased eightfold last year, with the lowest growth rate among the winners at 30%.

Diageo’s Smirnoff Smash Vodka Soda is available in four flavors—Pineapple Orange, Strawberry Dragon Fruit, Raspberry Peach, and Watermelon Lime—all at 4.5% abv and containing 100 calories. Diageo launched the brand with marketing muscle, including NFL and pickleball tie-ins. In addition to Smirnoff Smash, Diageo earned a second Hot Prospect award for Bulleit’s RTS cocktails. The drinks have steadily been gaining market share, rising 30% in 2024 to 130,000 cases. The RTS drinks are available in three varieties—Old Fashioned, Manhattan, and Whiskey Sour—with the third variant hitting shelves now, marketed as part of Diageo’s Cocktail Collection, which covers higher-proof bottled cocktails from Tanqueray, Crown Royal, Bulleit, and Ketel One. “The Bulleit Whiskey Sour offers an easy, elevated option for any occasion,” says Nikhil Shah, brand director at Diageo. “This latest addition to The Cocktail Collection brings one of America’s favorite cocktails to the ready-to-serve space, making it a simple, bar-quality drink to serve and enjoy all year round.”

Behind Smirnoff Smash is Gin & Juice, an independent brand launched by entertainers Snoop Dogg and Dr. Dre through Defiant Ones, LLC. Similar to Smirnoff Smash, Gin & Juice launched early in 2024 and caught fire immediately, reaching 215,000 cases. The brand is led by the original team behind On the Rocks (now part of Suntory Global Spirits)—Patrick Halbert, Andrew Gill, and Rocco Milano—and has backing from entrepreneurs Jimmy Iovine, Main Street Advisors, Marc Rowan, and Tom Werner. Gin & Juice is a slight departure among leading spirits-based RTDs. As the name says, it’s a gin-based cocktail and it clocks in at 5.9% abv, higher than the typical 4.5% abv used by the leading vodka soda brands. The cocktails come in Citrus, Melon, Passionfruit, and Apricot flavors.

Suntory Global Spirits’ -196 is 2024’s third-largest Hot Prospect RTD at 160,000 cases. The brand took off in 2024, with Suntory prioritizing it as part of a wider goal to be the leading producer of spirits-based RTDs. Though -196 is new to the U.S., the brand is the largest spirits brand globally by volume at more than 30 million cases in 2024, according to Impact Databank. -196 has recently expanded, adding a new lower calorie and abv variant. -196 Zero Sugar Lemon comes in at 4% abv and 85 calories per 355-ml. can. The new release joins Lemon, Strawberry, Grapefruit, and Peach in the brand’s U.S. portfolio. “We’re focused on attracting new customers in the United States, which is the largest RTD market, by expanding the distribution of -196 nationwide and launching new flavors, and introducing canned products for the On the Rocks brand, according to the company.

Betty Booze, from Alps Beverages and actress Blake Lively, is the fifth-largest Hot Prospect RTD, reaching 100,000 cases in its first year on the market. Helmed by spirits entrepreneur Andrew Chrisomalis, the brand is focused on more upscale flavors—like Sparkling Bourbon with Oak Smoked Lemonade or Vodka Iced Tea with Passionfruit—while still adhering to the lower-abv (4.5%) that marks many canned spirit and soda cocktails. “The RTD category is growing robustly, and is a reflection of broad consumption trends. We believe that consumers today are reading labels carefully. They’re asking what’s in their drink,” says Chrisomalis. “Nothing artificial—no fake sweeteners, no added colors, no aftertaste. We’re not just competing in this space—we’re aiming to elevate it.”

Following Betty Booze is another celebrity-backed brand, Sprinter, from realitty tv star Kylie Jenner and Calabasas Beverage Co. In its first year on the market, Sprinter reached 98,000 cases. The brand is handled nationally by Southern Glazer’s and comes in eight flavors—Black Cherry, Peach, Grapefruit, Lime, Pink Lemonade, Mango, Pineapple, and Strawberry—all at 4.5% abv.

Proximo Spirits earned two Hot Prospect RTS nods in 2024 with a pair of more traditional offerings: Jose Cuervo Authentic Raspberry Colada and 1800 The Ultimate Margarita Wild Berry. Both brands performed well in their first full year of wide availability, with the Cuervo release at 62,000 cases and 1800’s latest flavored Margarita at 61,000. Rounding out this year’s spirits-based RTD Hot Prospects are Pernod Ricard’s Absolut Ocean Spray Cranberry cocktails and Mom Water’s Dad Water. Pernod’s winner reached 57,000 cases in its first full year on the market. Dad Water, the only non-carbonated canned drink on this year’s list, grew 72% to 53,000 cases. The brand is an offshoot of Mom Water, the non-carbonated vodka-based fruit-flavored RTD label.

California Leads The Way

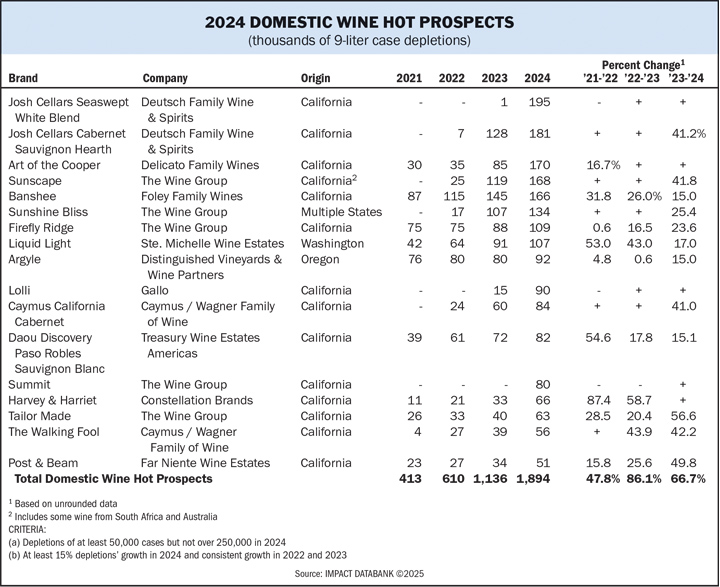

Impact’s annual Hot Prospects for wine feature 17 fast-rising domestic wines—with all but one making their debut on this year’s list—and 11 imports posting impressive volume gains. Total domestic wines in the 2024 Hot Prospects lineup collectively grew 66.7% to 1.89 million cases in the U.S. last year, according to Impact Databank. Most domestic awardees hail from California, including the top two entrants from Josh Cellars, but Washington and Oregon are represented as well.

As a 6.5-million-case brand, Josh Cellars is already a dominant player in the domestic wine category and boasts a series of innovative offerings. In 2024, the California heavyweight further distinguished itself with Seaswept White Blend and Cabernet Sauvignon Hearth. Seaswept was introduced nationally early last year, and by the end of 2024 had shot ahead to 195,000 cases in the U.S., making it the top 2024 domestic Hot Prospect wine. A blend of Sauvignon Blanc and Pinot Grigio, Seaswept ($16) offers a lower alcohol content of 11.5% and appeals to Gen Z consumers by opening up wine to more casual, energetic occasions, according to parent company Deutsch Family Wine & Spirits. “We activated large-scale experimental programs at high-traffic summer events, such as Coachella and Outside Lands,” says Dan Kleinman, chief brand officer of Deutsch. “We complemented these efforts with ongoing influencer partnerships to showcase new, high-energy ways to incorporate Seaswept into summer rituals.”

The second-ranking 2024 Hot Prospect domestic wine, Seaswept portfoliomate Josh Cellars Cabernet Sauvignon Hearth, has similarly experienced impressive growth in a relatively short time period. Last year, Hearth jumped ahead 41.2% to 181,000 cases. Hearth targets different occasions from Seaswept, resonating with consumers seeking richer, more indulgent options for at-home entertaining. “With Hearth, we were trying to actively move wine away from meal occasions into enjoyment on more casual occasions during colder months of the year after the meal is done, those occasions that close the evening with energy, fun, and connection,” says Kleinman.

The company says further releases are on the horizon. In the meantime, Seaswept and Hearth are building strong consumer followings. “Both wines were built to address a whitespace in the wine category and expand the occasions where Josh Cellars shows up,” says Kleinman. “The Seaswept and Hearth innovations are examples of how Josh Cellars continues to stand out in the crowded market by welcoming in a new kind of wine drinker.”

As the sole returning awardee on the 2024 Hot Prospects domestic wine roster, Banshee continued its strong growth streak last year with a 15% rise to 166,000 cases. A part of the Foley Family Wines & Spirits portfolio, Banshee appeals to younger LDA consumers looking for accessible luxury California wines priced between $20-$30 a bottle. Key offerings include Cabernet Sauvignon, Pinot Noir, Ten of Cups Sparkling, Chardonnay, Rosé, and Red Blend. Banshee shows no sign of slowing as it’s a high priority for its parent company.

Washington awardee Liquid Light from Ste. Michelle Wine Estates shot ahead 17% to 107,000 cases last year. Liquid Light wines are sourced from cool sites in the Yakima Valley and target the wellness trend with 95-calorie, low-sugar offerings. The portfolio features Sauvignon Blanc, rosé, Chardonnay, Pinot Grigio, Brut, and Brut Rosé.

The Wagner Family of Wine has two labels on the list this year in Caymus California Cabernet and The Walking Fool. While the California Cabernet retails at around $72, The Walking Fool is from the Suisun Valley AVA and sells closer to the $40 mark. Treasury Wine Estates earned honors with Daou Discovery Paso Robles Sauvignon Blanc. The Daou brand, which the company acquired in late 2023 for up to $1 billion, helped drive Treasury Americas to 15% sales growth to nearly $800 million in the year through June.

Constellation is also active in Paso Robles, having acquired the Booker label and associated brands in 2021. Among Booker’s offshoots is Harvey & Harriet, which doubled in size to 66,000 cases last year and includes red and white blends in the $20-$30 aa 750-ml.range.

Post & Beam is another up-and-coming brand, with parent company Far Niente Wine Estates boosting production in recent years. “We have been growing and we’ve been growing omnichannel, across distribution, wholesale, and direct to consumer,” says Andrew Delos, vice president of winemaking at Far Niente Wine Estates.

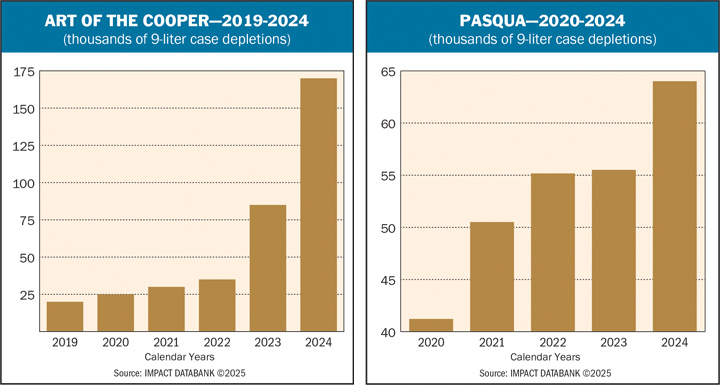

The Wine Group, which expanded with the acquisition of brands totaling 12 million cases and including Meiomi, Simi, and others, fielded five labels on the domestic list: Sunscape, Sunshine Bliss, Firefly Ridge, Summit, and Tailor Made. Top wine marketer Gallo earned a Hot Prospects nod with Lolli, and Delicato landed with the Art of the Cooper, which doubled in size to 170,000 cases last year. Finally, Oregon is represented with Argyle, from the Distinguished Vineyards & Wine Partners range, owned by Japan’s Kirin.

Imports Rising

Leading the imported wine list is Benvolio from Jackson Family Wines, which grew 16.3% to 133,000 cases in 2024. “Introduced in the late 2000s, Benvolio was a natural addition to our international portfolio—opening a gateway to the Friuli region, filling a need for light, refreshing wines at a value, and introducing Prosecco and Pinot Grigio, categories that were emerging at the time and continue to grow,” says JJ McCabe, senior vice president of U.S. sales at Jackson Family.

Benvolio’s growth has been centered around the on-premise channel. “Expanding by-the-glass placements and encouraging cocktail use have helped drive momentum for both Pinot Grigio and Prosecco,” says McCabe. “Strong consumer demand for crisp, refreshing whites and sparkling wines has further played to Benvolio’s strengths.”

New to the Hot Prospect awards is canned wine brand Archer Roose, which grew 43.7% in 2024 to 103,000 cases in the U.S.—earning it a spot on this year’s roster. Driven by a growing presence in the on-premise, Archer Roose includes a Chilean Sauvignon Blanc, Argentine Malbec, Italian sparkling wine, Italian sparkling rosé, and Italian Pinot Grigio. “There was a misconception that people didn’t want to drink wine out of a can, and that is not true, provided that it is high quality, provided that the experience is pleasurable,” Archer Roose founder and CEO Marian Leitner-Waldman recently told Impact.

French rosé has regained momentum with a return to pricing stability in the U.S. market. France’s Hampton Water Rosé returned as a Hot Prospect in 2024 with 33% growth last year to 102,000 cases. Nearly doubling in size over the past two years, the brand from Jon Bon Jovi, his son Jesse Bongiovi, and Gérard Bertrand has leveraged a strong social media presence as a lifestyle brand.

New Zealand wine Stoneleigh was another returning imported Hot Prospect wine, after growing 23.1% to 80,000 cases last year, double its 2022 volume. Stoneleigh is positioned for continued growth under its new owner, Vinarchy. Terlato-imported Wairau River, also from New Zealand, has kept up a torrid pace lately, nearly tripling in size over the past three years. Another kiwi brand, Opici-imported Giesen 0%, represents the growing non-alcohol segment, having surged to nearly 120,000 cases.

New Hot Prospect imported wine 2024 awardees are a diverse set, including France’s Côté Mas, which grew 58.1% to 72,000 cases; New Zealand’s Dashwood, which expanded 44.1% to 69,000 cases; and Italy’s Pasqua, which grew 15.3% to 64,000 cases last year in the U.S. Verona-based Pasqua credits commercial partnerships and an Italian portfolio tailored to meet local preferences in the U.S. for helping drive growth for the wine group’s lineup, which includes offerings like Famiglia Pasqua, Mai Dire Mai, 11 Minutes, Hey French, and Terre di Cariano Cecilia Beretta.

Avissi, from Trinchero Family Estates, is among the brands participating in the Prosecco trend, which has picked up speed again this year. Also from Italy, Ethica Wines’ Lavis hails from the Trentino region and topped 60,000 cases last year. Miami-based Ethica has U.S. volume of approximately 1.2 million cases and sales above $100 million.