Each year, Market Watch sister publication Impact Newsletter salutes the fastest growing brands in the U.S. drinks market with its “Hot Brand” awards. This year, the honor roll includes 72 brands across the spirits, wine, and spirits-based RTD categories. There are three different ways to qualify as an Impact Hot Brand: a contender must have shown double-digit growth in each year from 2020-2022, or be an established player with at least 15% growth in 2022, or be a top-ten brand with at least 5% growth in 2022 and 15% growth since 2019. The minimum volume requirement for spirits and imported wines is 200,000 cases, while domestic wines and RTDs must meet a threshold of 250,000 cases.

This year, 31 spirits brands earned Hot Brand honors. As expected, given the current strength of Tequilas and whiskies, those two categories lead the way, making up the vast majority of this year’s winners at 25 brands. The current crop of Hot Brand winners is less diverse than in years past; besides whisk(e)y and Tequila, only the vodka and liqueurs categories are represented, with three winners coming from each spirits segment. Between 2021 and 2022, gin, rum, and Cognac entirely dropped off the Hot Brands list.

Whisk(e)y, including all points of origin, was the largest category within this year’s spirits Hot Brand winners, with 13 brands making the grade. Breaking that down, Bourbon is the most popular subcategory, with seven winners, while Canadian whiskies scored two Hot Brand awardees, and Scotland, Ireland, and Tennessee each fielded one, as did the flavored segment.

Sazerac’s Fireball continues its reign as the largest whisky Hot Brand and second-largest spirits Hot Brand overall, excluding RTDs. The cinnamon-flavored whisky cracked 7 million cases in 2022, increasing 5.5% to 7.15 million cases. With Jameson and Maker’s Mark falling off this year’s Hot Brands list, the gulf between Fireball and the second-largest whiskey, Woodford Reserve, has widened. The Brown-Forman brand jumped 14% to 1.28 million cases last year. Recently, Brown-Forman promoted Elizabeth McCall to be Woodford Reserve’s master distiller, stepping into the role previously held by Chris Morris, who is now the brand’s master distiller emeritus. Woodford Reserve portfoliomate Old Forester also earned a Hot Brand nod, rising 13.1% to 427,000 cases.

Beam Suntory’s largest whiskey brand to earn a Hot Brand award is Basil Hayden, the third-largest Bourbon to make the grade. The brand has gained 11.5% and crested 500,000 cases for the first time, rising to 530,000 cases. The super-premium whiskey has added more than 200,000 cases since 2019. “We’re certainly seeing a shift to higher-end whiskies, clearly benefitting our small batch portfolio, represented by Knob Creek, Basil Hayden, Booker’s, and Baker’s,” Carlo Coppola, managing director of the James B. Beam Distilling Co., recently told Market Watch sister publication Shanken News Daily. “Newer Bourbon drinkers are entering the category through brands like Basil Hayden as they reconsider what American whiskey is and can be.”

Behind Old Forester and Basil Hayden are Four Roses’ namesake whiskey and Heaven Hill’s Elijah Craig. The larger brand, Four Roses, was up 10.5% to 415,000 cases, while Elijah Craig hit 402,000 cases, a nearly 34% gain. Since 2019, Elijah Craig’s growth has accelerated and, if trends continue, the Heaven Hill brand could overtake Four Roses this year.

The final two Hot Brand Bourbons are Bacardi’s Angel’s Envy and Pernod Ricard’s Jefferson’s, with both brands closing in on 300,000 cases. Angel’s Envy was up 32% to 295,000 cases for 2022, and Jefferson’s surged forward 66% to 290,000. Last year, Pernod Ricard formed a new American Whiskey Collective to markedly expand the presence of brands like Jefferson’s, Rabbit Hole, Smooth Ambler, and TX in the coming years.

Canada’s largest contender among this year’s Hot Brand winners is Diageo’s Crown Royal Peach, one of the more successful offshoots from the U.S. spirits market’s largest premium Canadian whisky. In 2022, the brand grew 13.5% to 800,000 cases. Since 2019, Crown Royal Peach has almost doubled in size. Proximo Spirits’ Pendleton is the second Canadian whisky to earn a Hot Brand award. Last year, the whisky was up 10.9% to 499,000 cases, continuing its steady ascent.

Rounding out this year’s Hot Brand-winning whiskies are releases from Scotland, Ireland, and Tennessee. Ole Smoky, from the Volunteer State, is the largest of these three, up 22.1% to 1.23 million cases across its portfolio of moonshines, whiskies, and flavored releases. For Scotch, Bacardi’s Dewar’s earned a Hot Brand win for its 2022 performance, when the brand was up 19.5% to 1.07 million cases,reversing a challenging 2021 and bringing the brand back above 1 million cases. “At $30, the reimagined Dewar’s 12-year-old is at the entry level of the $30-$50 segment on the premiumization ladder,” says brand vice president for North America Brian Cox. “Increasingly, 12-year-old is the new normal. We then see you up to Dewar’s 15-year-old as a special occasion and gifting option, and onward to the 18-year-old as a celebration whisky. We see an opportunity to deliver significant value here compared to single malts.”

Finally, Pernod Ricard’s Jameson Orange earned a Hot Brand award in its first year on the market. The flavored offshoot of America’s largest Irish whiskey depleted 215,000 cases in 2022.

Just behind whisk(e)y is Tequila with 12 Hot Brand winners. This year, all 12 winning Tequilas are made from 100% blue agave. They cover a range of prices, but most are concentrated in the super-premium and luxury pricing tiers. The leader is Diageo’s Casamigos. In 2022, the brand gained 67% to reach nearly 2.4 million cases, making it the third-largest Hot Brand overall. Behind Casamigos is another high-end Diageo Tequila, Don Julio, which is now being extended with a Rosado offering aged in Ruby Port casks. The brand was up 12.5% to 2.08 million cases. Last year was the first year that Casamigos overtook Don Julio in terms of volume. “Tequila still has a long runway in the U.S.,” Diageo CEO Ivan Menezes noted recently.

Proximo Spirits’ 1800 is nearly the same size as Don Julio and grew at the exact same rate. The brand was up 12.5% to 2.03 million cases in 2022. As the leading Tequila marketer in the U.S., Proximo has two other Hot Brand Tequilas, Jose Cuervo Tradicional and Gran Centenario. Tradicional, the upscale and 100% agave offshoot of the largest Tequila in the U.S., was up 12.5% to 397,000 cases. Gran Centenario, building from a smaller base, was up 25.2% to 230,000 cases. Cuervo’s total U.S. and Canada sales rose 6.6% last year to $1.5 billion despite a 2.5% decrease in volume to 15.4 million cases. According to the company, North American sales were “driven by better price mix as a result of our premiumization strategy and partially offset by a 2.5% decrease in volume and Mexican peso appreciation against the U.S. dollar on a year over year basis.”

Behind 1800, Tequila volumes drop off a bit, though there are still two brands above 1 million cases. The larger of the two is Beam Suntory’s Hornitos at 1.69 million cases. In 2022, the brand was up 12%. Campari’s Espolòn is also above 1 million cases, at 1.11 million for 2022. The brand grew 13.4% last year, doubling in size since 2019. While not yet reaching the million-case mark, Heaven Hill’s Lunazul will almost certainly cross that milestone soon. Last year, the brand was up 48.1% to 918,000 cases. Teremana, meanwhile, is in a similar position. Last year, the ascendant brand jumped 46.5% to 900,000 cases in only its third year on the market. If these brands continue to perform, there could be seven Tequila brands over one million cases among next year’s Hot Brands.

Other Hot Brand Tequilas above 500,000 cases include Bacardi’s Cazadores and William Grant & Sons’ Milagro. The Bacardi brand advanced 26% to 759,000 cases and Milagro grew 21.4% to 605,000 cases. Rounding out the Hot Brand-winning Tequilas is Spirit of Gallo’s Familia Camarena at 435,000 cases, rising 16% in 2022.

Vodka earned three Hot Brand awards, led by Tito’s, the largest traditional spirits brand in the U.S. (and second-largest overall behind only Spirit of Gallo’s vodka-based seltzer High Noon Sun Sips). In 2022, Tito’s grew another 5% to reach 11.55 million cases, continuing the brand’s decade-long run. The other two Hot Brand vodkas are Western Son’s eponymous vodka, up 14.3% to 416,000 cases; and William Grant & Sons’ Reyka, the sole imported vodka to earn a Hot Brand award. Last year, the Icelandic vodka increased 11% to 205,000 cases.

Domestic and imported liqueurs claimed the final three Hot Brand awards in 2022. The largest, Campari America’s Aperol, jumped 27.9% to 390,000 cases, buoyed by the popularity of the Spritz cocktail. In recent years, Aperol’s performance has accelerated and it shows no signs of slowing down. Portfoliomate and company namesake Campari also earned a Hot Brand award for 2022. The bitter grew 16.1% to 227,000 cases. Finally, Charles Jacquin et Cie.’s Pennsylvania Dutch cream liqueur earned its first Hot Brand award, as the brand increased 10.4% to 254,000 cases last year.

RTDs In High Gear

Twenty-two spirits- and wine-based ready-to-drink labels qualified as Hot Brands this year. The category has changed dramatically since the White Claw craze of 2019 vaulted malt-based seltzers to prominence and inspired countless imitators. But growth for malt-alcohol drinks has slowed as consumers quickly scaled up their interest to spirits- and wine-based options. Consumers’ longstanding interest in authenticity and high-quality ingredients has overtaken the category, raising the fortunes of a new generation of RTDs.

Of the 22 Hot Brand RTDs, more than half did not exist in 2019 and some launched only in 2021. Their collective volume in 2019 was just 3 million cases compared to 32.3 million last year, representing an 81% increase, up from 17.8 million cases in 2021. The list features 12 returning Hot Brands and ten new honorees, six having dropped off from last year.

The RTD list is led by Spirit of Gallo’s High Noon Sun Sips, which has made an unprecedented ascent to its position as the largest spirits brand in the U.S., overtaking Tito’s in just a few years. Its Vodka Soda line consists of flavors including lime, pineapple, and peach, among others, at 4.5% abv. Following a 2021 in which it roughly tripled its volume to 8.8 million cases, High Noon grew another astounding 85.6% in 2022 to reach 16.4 million cases. It accounts for half the total volume among the RTD Hot Brands honorees. “High Noon meets consumers where they naturally want to go when they’re ready to move beyond entry-priced seltzers,” says Spirit of Gallo vice president and general manager Britt West. “Consumers also care about ingredients, which is how High Noon got established versus malt-based beer: High Noon consumers appreciate real vodka.” High Noon is also making a major expansion with the recent launch of High Noon Tequila Seltzer, its first push into spirits beyond vodka.

Spirit of Gallo fielded another Hot Brand with Liqs. The brand has its own identity, marketing both 750-ml. bottles and wine-style boxes of premixed cocktails, as well as sealed shot cups. At 255,000 cases last year, it’s much smaller than its juggernaut compatriot but is growing quickly, having roughly tripled its volume last year.

Another notable trend in the RTD business is legacy spirits brands launching canned cocktail offshoots made with the core product. Diageo North America has found success with its Crown Royal RTDs, which include Whisky & Cola, Peach Tea, and Washington Apple, all made with Crown Royal Canadian whisky. The line advanced 60% to an even 1 million cases last year. Similarly, Brown-Forman now makes Jack Daniel’s Canned Cocktails using Tennessee Apple, Tennessee Honey, and Tennessee whiskey to make the flavors Apple Fizz, Lemonade, and Cola, respectively, all at 7% abv. The line grew 61% to 419,000 cases last year.

Pernod Ricard made the list for two of its brand extensions, Absolut Cans and Malibu Rum Cans. The former, which sports vodka soda options at 5% abv and cocktail flavors at 7% abv, increased 28% to reach 407,000 cases last year. Malibu’s canned line, meanwhile, grew sevenfold to reach 366,000 cases. Beam Suntory’s On The Rocks ready-to-serve label brings together spirits from across the company’s portfolio, like its Cosmopolitan made with Effen vodka, its Old Fashioned made with Knob Creek whiskey, and its Margarita made with Hornitos Tequila. On The Rocks grew 37% to 570,000 cases last year.

Bacardi likewise launched Cazadores Tequila RTDs in 2021 to a strong reception. The brand grew 52% in 2022 to reach 296,000 cases, with Margarita, Paloma, and Ranch Water options. The trend even extends to The Boston Beer Co., which now uses its Dogfish Head distilling operation to produce a line of Dogfish Head seltzers made with its in-house spirits. The seltzers were up 73% in their second year on the market, reaching 295,000 cases.

Anheuser-Busch InBev (A-B InBev) took a different tack with the rollout of Nutrl Vodka Seltzer in 2021. The standalone vodka soda brand exploded in popularity last year, rising from a minimal base to 900,000 cases, driven by its variety six-pack of fruit flavors. Two A-B InBev subsidiaries also made the list, Cutwater Spirits and Devils Backbone. At 2.6 million cases, Cutwater’s RTD line is second only to High Noon on the RTD list. Its line is made with various spirits including Tequila, vodka, rum, and whisky, and recently received a new ad campaign and packaging refresh. Devils Backbone Distilling Co., part of Devils Backbone Brewing Co. acquired by A-B InBev in 2016, also produces a line of eponymous canned cocktails. The brand rose 50% to reach half a million cases in its third year on the market.

Southern Champion’s Buzzballz family of products returned to the list this year with both the wine-based Chillers line and the spirits-based Cocktails line. Both accelerated last year, with Buzzballz Chillers gaining 70% to reach nearly 1.2 million cases while the cocktail line rose to 722,000 cases on a similar growth rate. Buzzballz products stand out from the pack with their spherical packaging. Another wine-based RTD on the Hot Brands list is Beatbox, from Future Proof Brands. It more than doubled in volume to reach 1.1 million cases.

Elsewhere in spirits, several dedicated Tequila brands are challenging vodka’s category supremacy. Onda Tequila Seltzer, from Que Onda Beverage, joined the list following a strong year in which sales rose to 260,000 cases. Mamitas, from Phusion Projects, also produces Tequila & Soda seltzers in flavors including Lime, Paloma, Mango, and Pineapple. The brand reached 250,000 cases on 32% growth.

Producing both vodka and Tequila options, Carbliss had a stellar 2022. The SNFood brand broke out last year, growing tenfold to 400,000 cases. Similarly producing vodka and Tequila drinks is Atomic Brands’ Monaco label, which was up 33% to 2.5 million cases.

The national drink of Finland continues to make inroads in the U.S. as well. The Long Drink, a gin-based cocktail now produced as an RTD by The Long Drink Co., reached 1 million cases on triple-digit growth, making it by far the most successful gin brand among canned cocktails. Another vodka-based brand is Mom Water. Now available in more than 20 states, Mom Water is non-carbonated and each flavor sports a common Baby Boomer-era woman’s name like Nancy, Linda, and Susan. From a first-year base of 38,000 cases in 2021, Mom Water reached 481,000 cases in its second year. The final brand on the RTD Hot Brands list, Two Chicks gained 45%, reaching 310,000 cases. The label produces RTDs using various spirits.

California Wine Remains Dominant

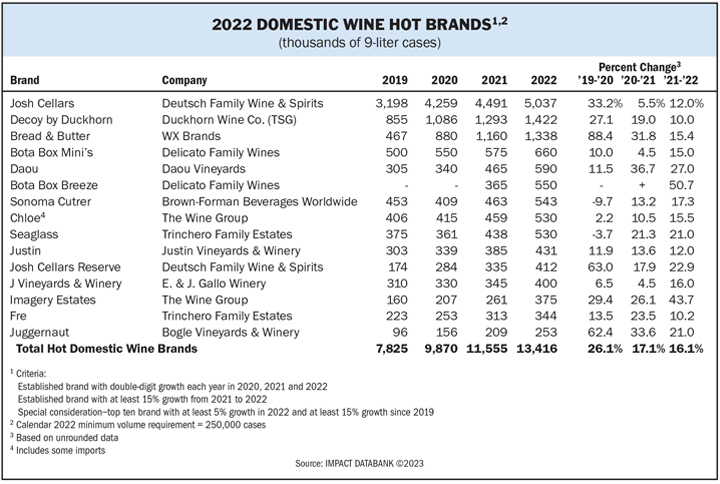

Impact wine Hot Brands totaled 19 top-performing labels from across the domestic and import segments for 2022. On the domestic side, 15 brands from last year’s list failed to meet Hot Brand criteria and fell from the ranks, although nearly all of those managed to remain in positive growth, even after many of them battled tough comps following the booming volume gains of the last few years.

Leading wine’s Hot Brands is Deutsch Family Wine & Spirits-owned Josh Cellars, which surpassed the 5-million-case mark, up from 3.2 million cases as recently as 2019. As large as the brand has become, Deutsch still sees opportunities for Josh Cellars to grow with its Cabernet Sauvignon, Chardonnay, Sauvignon Blanc, and Pinot Noir as they gain an even wider distribution base. It has also expanded the range to include popular styles like Prosecco in recent years.

While the U.S. wine industry’s recruitment of younger consumers has lagged that of spirits, Josh has been adept at bringing 21 to 35 year olds into the mix, boasting a younger consumer base than is common within its accessible price tier. Deutsch is also intent on stoking further gains for higher-priced Josh Cellars Reserve, a Hot Brand in its own right that is now above 400,000 cases, up from fewer than 200,000 cases in 2019.

The second-largest domestic wine Hot Brand is Decoy by Duckhorn, which crossed a key milestone by surpassing 1.4 million cases in U.S. volume. Along with Meiomi and La Crema, Decoy is among the leading $15-plus wine brands by volume in the U.S. It has been a key growth engine for parent company The Duckhorn Portfolio, which saw sales increase 11% to $373 million in its fiscal year through July 2022, as adjusted EBITDA grew 9% to $128 million.

Indeed, while premiumization appears to have slowed some in the wine category, higher-end wines continue to outperform overall. “The divergence between lower price and higher price has never been wider,” Rob McMillan, executive vice president for Silicon Valley Bank and head of its wine division, told Market Watch sister publication Wine Spectator. “We really have two different wine industries now.” In addition to Decoy, several other above-$15 wine labels earned Hot Brand honors, among them Sonoma-Cutrer, Justin, and Daou Vineyards.

Of that trio, Daou is the biggest brand, having almost doubled in size since 2019 to approach 600,000 cases. Situated on a 212-acre hilltop estate in the Adelaida District of Paso Robles, California, Daou is known for Cabernet Sauvignon and other Bordeaux varieties. Brothers Georges and Daniel Daou are now also embarking on a project in Italy, having recently purchased 170 acres in the Val d’Orcia region of southern Tuscany, with plans to make IGT Toscana wines from Bordeaux varieties.

Sonoma-Cutrer, a 540,000-case brand known for Russian River Valley Chardonnay, last fall unveiled a new creative platform and campaign, “Bonjour Sonoma,” created in partnership with advertising agency Energy BBDO and focused on “paying homage to the brand’s strong roots in a modern, elegant way,” according to the company. “The new campaign really captures the essence of Sonoma-Cutrer and will work to elevate us with consumers in a crowded category,” says senior brand manager Tracy Thornsberry. “We’re excited to bring our world to life outside our vineyard.”

Paso Robles-based Justin, meanwhile, topped 400,000 cases in 2022 after averaging more than 12% growth over the past three years. Justin is part of The Wonderful Co., which owns Fiji Water and POM Wonderful, among other brands. The Wonderful Co. expanded its wine interests recently with the purchase of Napa’s Robert Sinskey Vineyards for just over $26 million. The property was then leased back to the Sinskeys, who will continue to run the vineyards and the company’s tasting room.

Sonoma-based Imagery winery has been among The Wine Group’s successful premiumization plays of recent years, having more than doubled to 375,000 cases since 2019. Imagery was initially an on-premise-only label that has now made significant inroads at retail as well. Stablemate Chloe, another brand higher up the pricing ladder for The Wine Group, is best known for white wines and likewise reached Hot Brand status by climbing past the 500,000-case threshold in 2022.

From Novato, California’s WX Brands comes Bread & Butter, which has soared past 1.3 million cases, up from fewer than a half-million cases pre-pandemic. Most recently, Bread & Butter added a California Pinot Grigio, sitting alongside Chardonnay, Pinot Noir, Cabernet Sauvignon, Merlot, Sauvignon Blanc, Rosé, and Prosecco in the portfolio. Argentina’s Bemberg family, through its Terold company, took a majority stake in WX Brands in 2021, bringing WX into the fold with Grupo Peñaflor, Argentina’s largest wine exporter.

Trinchero Family Estates has a pair of Hot Brands in Seaglass and Fre. Seaglass cracked the 500,000-case mark in 2022, rebounding strongly over the past few years amid the on-premise return. The brand, anchored in Santa Barbara County’s Los Alamos Vineyard, includes Sauvignon Blanc, Pinot Grigio, Chardonnay, Rosé, Riesling, Pinot Noir, and Cabernet Sauvignon in its range. Portfoliomate Fre is among the brands driving gains in the dealcoholized wine segment. Dealcoholized wines overall grew 21% to $54 million in NielsenIQ channels last year, with Fre among the most prominent brands at 344,000 cases.

From Delicato Family Wines, Bota Box has two innovations on the Hot Brands list. Bota Box Breeze, competing in the light wines segment, jumped 51% to 550,000 cases in the U.S. last year. In May, it will be extended with a Chardonnay and become available at national retailers like Kroger, Total Wine & More, and Meijer. Each 5-ounce serving contains 3 grams of carbohydrates, 80 calories, and has an alcohol level of 8.5%. The newcomer joins Pinot Grigio, Dry Rosé, Sauvignon Blanc, and Red Blend in the Bota Box Breeze portfolio. “A Chardonnay offering makes a compelling addition to the Bota Breeze lineup and builds on the brand’s terrific momentum,” says Delicato vice president of marketing Kathy Pyrce. “Chardonnay claims the third-largest varietal dollar share in the light wine category, and sales of light Chardonnay are up 60% in volume compared to a year ago.” Bota Box Minis, meanwhile, climbed past 600,000 cases last year on continuing double-digit growth.

Clarksburg, California-based Bogle Vineyards & Winery is represented by its Juggernaut brand, which includes a Sonoma Coast Chardonnay, Russian River Valley Pinot Noir, and Hillside Cabernet. Juggernaut is now above a quarter-million cases. E. & J. Gallo’s J Vineyards & Winery reached 400,000 cases last year, leveraging a portfolio that includes sparkling and still offerings from the Russian River Valley.

Gallo also has two imported Hot Brand wines this year in sparkling leader La Marca and New Zealand label Whitehaven. La Marca topped 3 million cases in the U.S. in 2022, and is the Prosecco category’s clear standard-bearer with a portfolio that includes the core bottling as well as a rosé and the higher-priced Luminore DOCG offering. Whitehaven also continues to churn forward, surging past 700,000 cases on 14% growth.

Also from New Zealand, Oyster Bay is back on the Hot Brands honor roll, with volume now above 1.2 million cases. Boosted by the ongoing strength of Kiwi Sauvignon Blanc, the brand rebounded strongly after a slight decline in 2021, and is now almost 300,000 cases bigger than it was before the Covid-19 pandemic.

Deutsch Family Wine & Spirits has the largest wine Hot Brand this year in Josh Cellars, and also the smallest of the bunch in Yellow Tail Pure Bright, which is showing promise in the light wine category, climbing past 200,000 cases last year. While the light wine segment continues to grow more crowded, Yellow Tail’s strong brand recognition gives it a leg up in separating from the pack, with Pure Bright already a significant player in the category just two years after launch.

Lately, the wine industry has been beset by worries that much of its audience remains in the over-50 age group, with younger drinkers being slow to join the category, preferring spirits and RTD offerings. Still, these 19 Hot Brand award winners show that it’s possible to generate impressive growth in wine, and often capture long-term consumer loyalty in the process.