Spirits sales at on-premise venues returned with a vengeance last year in the nation’s 17 control states. On-premise spirits volume increased 11.2% and dollar sales jumped 17.3% to approximately $2.2 billion, according to NABCA/Impact Databank. This double-digit growth was partially driven by an average 5.6% increase in selling prices and offset a 0.3% off-premise decrease in dollar sales. “The year finished very strong,” says David Jackson, senior vice president of trade relations at the National Alcohol Beverage Control Association (NABCA). “The total volume was down in the first six months, but the dollars were up. It’s a positive price mix.”

RTDs led growth rates with a 30.1% gain to 2.95 million cases. Tequila was the fastest growing traditional spirit in 2022, with an 8.9% increase to 5.94 million cases, according to Impact Databank. Irish and domestic whiskeys experienced double-digit gains in on-premise volume and dollar sales. “The growth is being driven by the canned spirits cocktails, higher-end Tequilas, and domestic whiskeys,” Jackson says. “Domestic whiskey finished flat but had good dollar growth driven by single barrel and higher retail priced offerings. The decline in Cognac has driven the overall business down.”

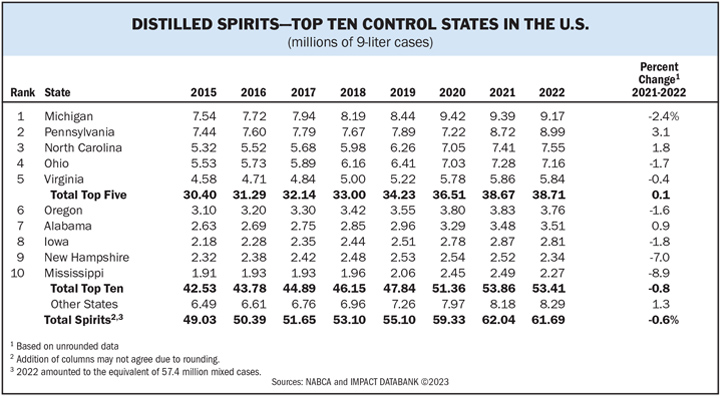

Overall spirits volume in control states dipped slightly last year, decreasing 0.6% to 61.69 million 9-liter cases. Seven of the top 11 spirits categories in control states decreased. Of the top ten spirits brands by volume, No.-1 Tito’s ($20 a 750-ml. in Michigan) posted the highest growth rate with an 8.9% gain to 3.13 million cases. No.-3 Fireball ($15 a 750-ml.), which increased 2.3%, and No.-8 Jose Cuervo ($23 a 750-ml.), which saw 2.5% growth, were the only other top ten spirits brands to grow in the control states in 2022. Brandy volume, including Cognac, was down 15.7%, or 540,000 cases, and was the biggest contributing factor to the spirits volume loss in control states. Despite Tito’s growth, total vodka volume dipped 1.9% to 19.29 million cases. From smaller bases, Canadian whisky (-1.9%), rum (-4.4%), gin (-5.6%), Scotch (-6.3%), and blended American whiskey (-4.1%) all declined in volume in the 2022. Cordials and liqueurs were roughly flat at 4.5 million cases.

At The Top

Among the top ten control states by spirits volume, Pennsylvania, North Carolina, and Alabama were the only states to post category growth. Pennsylvania posted the highest spirits growth rate at 3.1% to 8.99 million cases. If trends continue, Pennsylvania is on pace to pass Michigan this year to become the top control state by spirits volume. Michigan remained the No. 1 control state by spirits volume last year, despite a 2.4% decrease in spirits volume to 9.17 million cases. While Pennsylvania is on the state’s heels as volume leader, Michigan has a much bigger lead in total dollar sales, registering $2.16 billion last year as compared to Pennsylvania’s approximate $1.7 billion. “Our top two sellers for 2022 were vodka and Tequila,” says Michigan Liquor Control Commission chairman Pat Gagliardi. “Tito’s and Patrón are having a good run in Michigan.”

In Michigan, it pays to have popular spirits brands in multiple bottle sizes. Four of the top five spirits SKUs in Michigan were all Tito’s: 750-ml. ($20), 1-liter ($27), 1.75-liters ($36), and 375-ml. ($10), with Patrón Silver in the 750-ml. size ($53) in the fourth spot. Tito’s grew 8.5% to 567,000 cases in Michigan, remaining the top spirits brand in the Wolverine State. Fireball ($15 a 750-ml.), which rose 0.8%, and New Amsterdam vodka ($13 a 750-ml.), which gained 4.6%, were the only other top ten spirits brands to grow in Michigan last year.

After several delays the past couple of years, state officials plan to spend slightly more than $9 million to upgrade the Michigan Liquor Control Commission’s computer system. “We’re making a big modernization surge in the way we do business with a look at the future,” Gagliardi says. It’s going to take us into a whole new role.”

Gagliardi is optimistic spirits will grow this year. “The economy is good in the upper Midwest, with Ford and GM spending big,” he says. “Tourists are making plans to come here. If we don’t go into a recession, we’ll be fine. Job numbers continue to increase. I think we’ll grow this year.”

Tar Heel Gains

North Carolina shored up its position as the No. 3 control state by spirits volume last year with 1.8% growth to 7.55 million cases. Of the top five spirits brands in the Tar Heel state, Tito’s ($23 a 750-ml.) was the only one to grow, posting a 9.8% gain to 377,000 cases. The top five included two other vodkas, though both decreased, with No.-4 Smirnoff ($13) down 20%, and No.-5 Burnett’s ($8) declining 8.9%. Rounding out the top-five list are Crown Royal ($34), which decreased 4.1%, and Bacardi ($14), which was down 2.9%. Other popular brands in North Carolina include Jack Daniel’s Black Label ($29) and Patrón Silver ($50), which both increased. “We’re continuing to see significant growth in premium-plus Tequila, Bourbon, and RTDs,” says Jeff Strickland, public affairs director for the North Carolina ABC Commission.

While North Carolina ABC Boards are not able to advertise or promote individual items, the most significant in-store promotions used to generate consumer interest and purchases are monthly special purchase allowances, supplier rebates, and tasting events. “Many public groups and clubs around the state are very active on social media promoting their local ABC boards and stores,” Strickland says. “Facebook is probably the most common platform.”

The state’s beverage alcohol growth is helped by its increasing number of residents. By population growth, North Carolina is ranked fourth in the nation and ninth in total population, according to the United States Census Bureau. The Tar Heel population was estimated at approximately 10.7 million in July 2022, up about 133,000 people from the year prior. In other action, the state’s General Assembly is considering House Bill 94 to provide local governments authority to allow certain types of sales and advertising—particularly happy hours.

On-Premise Leader

Spirits volume in Ohio decreased 1.7% to 7.16 million cases last year, but the Buckeye State leads control states in on-premise category dollar sales, which increased 9.3% to reach $434.4 million in 2022. Consequently, total spirits revenue in Ohio increased 0.76% in 2022. “The national trend of premiumization holds true in Ohio. Whiskey, Tequila, and vodka made up most sales in Ohio,” says Ohio Division for Liquor Control (OHLQ) superintendent Jim Canepa.

The OHLQ focused on product offerings, customer experience, and education last year. “In 2022, ‘store events’ were added to the homepage navigation highlighting opportunities such as bottle signings and tastings,” Canepa says. “The ‘holiday gift finder’ in November included a quiz to guide consumers in discovering gift packs, premium products, and recipes they may enjoy.”

Launched in 2021, OHLQ.com allows consumers to locate products or search the inventory of any store. Product availability is updated every 15 minutes, improving inventory capability. Content articles on the site feature product discovery, spotlight category trends, and encourage responsible consumption. OHLQ also launched a subscription newsletter through the site in February 2022, which now goes out to 72,000 people. Emails include new product offerings, exclusive releases, seasonal recipes, event highlights, and responsibility initiatives.

OHLQ published nearly 900 Facebook and Instagram social media posts last year encouraging exploration through spirits education. Content includes ‘Whiskey Wednesday’ posts focusing on the spirit’s history, recipes, and information encouraging brand exploration. In all, OHLQ sold 450 single barrels last year through its Exclusive program, including 96 barrels on ‘Single Barrel Saturday’ in December. “We seek out rare, premium, and small-batch bottles so we know we’re carrying the sought-after products Ohioans want,” Canepa says. Among other promotions, the OHLQ also held multi-day, multi-location ‘liquordation’ events in pop-up stores featuring discontinued and discounted products.

The Buckeye State also saw a step forward for its craft spirits segment in 2022. Ohio sold products from 61 craft distilleries, including six that opened just last year. Craft distilleries in Ohio are thriving, producing more than 649 products and $26 million in dollar sales last year, a 19% growth over 2021.

Premiumization Push

In Virginia, spirits volume was slightly down, dipping 0.4% to 5.84 million cases. Nevertheless, premiumization and incremental package sizes contributed to the Virginia Alcoholic Beverage Control Authority’s (Virginia ABC) revenue growing 3.4% in fiscal 2022. During fiscal year 2022, $14.6 million of the increase in store sales was driven by consumers selecting higher quality brands, and $40.2 million of the increase in store sales was driven by an increase in the number of bottles or units sold, the Virginia ABC notes. “The on-premise sector will continue to rebound, likely outpacing our retail business in growth,” says CEO Travis Hill. “Supply chain disruptions are starting to moderate, but we continue to see higher out of stocks than were normal before the pandemic.”

In 2022 Virginia ABC saw a return to pre-Covid buying patterns. Consumers switched back to purchasing more 750-ml. and 50-ml. products and decreased 1.75-liter purchases. Additionally, the authority saw an inflationary impact on retail prices as suppliers raised prices. Online sales decreased from 2021 but remain well above pre-pandemic levels. Virginia ABC is also in its second year in its new distribution center. “The new distribution center gives us plenty of capacity to continue to grow our store fleet and add new products,” Hill says. “With the new facility we’re also able to further develop our e-commerce offerings that were jumpstarted during the pandemic.”

Virginia has also ramped up its spirits marketing and merchandizing. Promotional activities include Mini Monday, Spirited Thursdays, Doorbusters, holiday campaigns, and programed four-sided kiosks featuring cocktail recipes. Instagram grew from less than 1,500 followers in March 2022 to more than 21,000 in February 2023. Facebook increased from 24,568 followers to 46,167 in the same time period. “Our Spirited Virginia Facebook and Instagram accounts have grown immensely since we began posting about our limited availability product drops,” says Virginia ABC director of marketing and merchandizing John L. Shiffer. “We program all in-store displays to ensure they feature products aligning with our strategy to increase the average shopper’s basket with more premium purchases and more bottles.”

Dynamic brands, premiumization, and incremental packaging are expected to drive spirits growth in Virginia and throughout control states. “Spirits sales are continuing to normalize after Covid-19, and we anticipate spirits will grow relative to other beverage alcohol categories,” Hill says. “The risk of a recession has us conservative in our current forecast for fiscal year 2024, but we still expect to grow.”