Each year, Market Watch and its sister publication Impact Newsletter recognize the past decade’s leading spirits, wine, and beer brands in the U.S. market with the “Blue Chip Brand” awards. To meet Blue Chip criteria, brands must show at least ten consecutive years of volume growth, or AACGR of at least 2% for spirits, 1.5% for wine, or 1% for beer from 2014 through 2024, with positive growth in at least eight of those ten years. In addition, the brands must have maintained gross margins of at least $25 million last year. Despite market challenges in recent years, the current crop of Blue Chip-winning beverage alcohol brands have stood the test of time, continuing to carve out consistent growth over the long term.

Leading Spirits

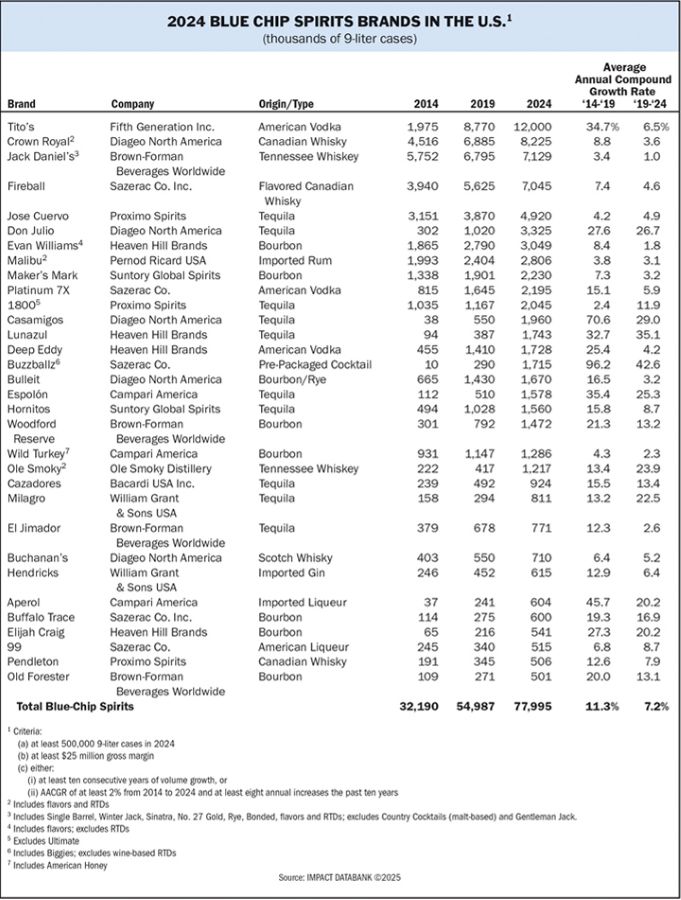

This year, 32 spirits brands earned Impact’s Blue Chip award. The winners cover a wide spectrum, with strong categories like American whiskey and Tequila making up a large share of the list. While the bulk of this year’s Blue Chip winners are returning favorites, four new brands—Sazerac’s Buffalo Trace and 99, Heaven Hill’s Elijah Craig, and Brown-Forman’s Old Forester—made their debuts on the honor roll. Of the winners, 14 come from whisk(e)y (including flavors) and ten come from Tequila, making up the majority of the list. Vodka scored three Blue Chip Brands (including Fifth Generation-owned Tito’s, the largest overall), liqueurs landed two, and rum, gin, and pre-packaged cocktails each earned one Blue Chip award.

At 12 million cases, Tito’s vodka leads this year’s Blue Chip winners by nearly 4 million cases. Ten years ago, the brand was already a leading vodka at just under 2 million cases, but over the last decade its trajectory veered steeply upward, with Tito’s reaching 8.77 million cases in 2019 and seeing steady growth over the next few years before slowing in 2023 and 2024. For the half-decade from 2014 to 2019 the brand’s averaged annual compound growth rate was nearly 35%.

While Tito’s remains a singular product, released in a variety of sizes, Fifth Generation recently made its first acquisition, buying a majority stake in Tequila brand Lalo. The brand, known for its single blanco expression that averages $46 a 750-ml. in NielsenIQ channels, recently earned Impact “Hot Prospect” honors after more than doubling in size to 155,000 cases in the U.S. last year. This year, it’s on track to potentially double its volume again.

“This opportunity is about leveraging a blueprint that Tito himself pioneered with Tito’s Handmade vodka, one that proves you can build something enduring by focusing on quality, authenticity, and doing one thing right,” Tito’s president Jon Tepper recently told Market Watch sister publication Shanken News Daily. “Lalo Tequila shares those same values, from its dedication to ingredients to the family story behind the brand.”

Behind Tito’s is Diageo’s Crown Royal, the largest Blue Chip whisk(e)y brand at 8.23 million cases, including flavors and RTDs. In 2014, Crown was at 4.5 million cases, already a giant within the category. Since then, through a series of new flavor expressions, limited editions, and other line extensions, Diageo has continued to build on Crown’s success. Most recently the brand added Crown Royal Chocolate, a new limited time offering. “Crown Royal has always led the way in whisky innovation and with this new flavor we’re inviting people to indulge in something truly unexpected,” says Hadley Schafer, vice president of Crown Royal.

Brown-Forman’s Jack Daniel’s comes in as the third-largest Blue Chip Brand at 7.13 million cases for 2024. The brand added nearly 1.4 million cases over the last decade, averaging solid growth each year. Brown-Forman has focused on a mix of flavored releases, like the recently launched Tennessee Blackberry, and higher-end offerings drawn from the brand’s massive stocks of aged whiskey. Most recently, Jack Daniel’s made its Single Barrel Heritage Barrel bottling a year-round offering. “We’re starting to see positive trends and improvements, especially around our innovations such as our recently released Jack Daniel’s Aged Series and our award-winning Jack Daniel’s Bonded Series,” says Mark Bacon, Jack Daniel’s senior vice president and global managing director.

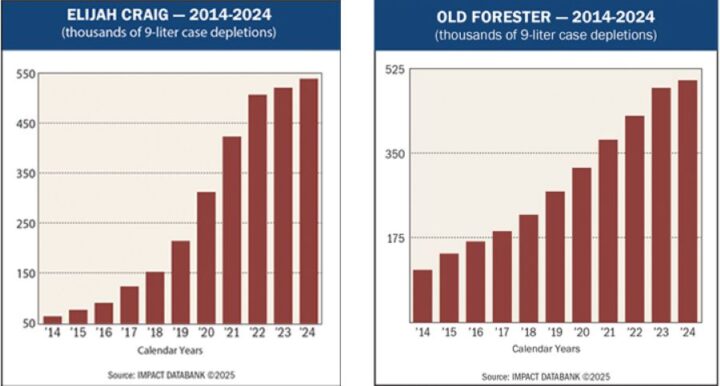

Brown-Forman also won awards for Woodford Reserve and Old Forester. Woodford, one of the leading super-premium whiskeys in the U.S., averaged 17.2% growth per year over the last decade, growing from just over 300,000 cases in 2014 to nearly 1.5 million cases last year. Old Forester, a new Blue Chip Brand, averaged 16.5% growth in the last ten years, rising from roughly 100,000 cases in 2014 to 501,000 cases last year.

Behind Jack Daniel’s is Sazerac’s Fireball, the largest flavored whisk(e)y to earn Blue Chip status. Last year, the brand reached 7.05 million cases, adding more than 3 million cases over the last decade. Long a single-label brand, Sazerac branched the brand out into malt-based offerings in 2021, and this year added a new extension, Blazin’ Apple.

Tequila Looms Large

Proximo’s Jose Cuervo, the largest Tequila brand in the U.S., likewise ranks as a Blue Chip. Last year, the brand was at 4.9 million cases. Over the last decade, Cuervo averaged 4.6% growth per year, adding nearly 2 million cases as America’s appetite for Tequila grew substantially. Proximo continues to innovate to bring new consumers into the brand. “Last fall, we released the newest offering from Cuervo, Devil’s Reserve, a sweet, tropical, and spicy infused Tequila. We know legal-drinking-age Gen Z and younger millennials are craving lower-abv and flavor-forward options, and Devil’s Reserve meets that call,” says Lander Otegui, CMO at Proximo.

Diageo’s Don Julio, the sixth-largest Blue Chip Brand, is one of the drinks business’s great success stories of the last decade. In 2014, the upscale Tequila was at 302,000 cases in the U.S. After a decade of averaging 27% growth per year, the brand is at 3.33 million cases and is one of a handful of billion-dollar spirits brands. Despite overall headwinds in the spirits industry in 2025, Diageo says Don Julio is continuing to thrive in the U.S. “In North America, positive price/mix was driven by Tequila, with consumers increasingly moving to aged liquids, and with strong performance particularly from Don Julio Reposado,” says interim CEO Nik Jhangiani.

Diageo’s Casamigos also earned a Blue Chip honor and has greatly benefited from America’s embrace of higher-priced Tequilas. In 2014, Casamigos was at 38,000 cases in the U.S. Last year, it was at 1.96 million cases. The brand, however, has struggled in the last year and a half, with Diageo working to revitalize Casamigos through a new ad campaign and entry into the RTD space with a premixed Margarita. “Although early days, we are encouraged by the take-up and feedback from both retailers and consumers to date and will be leveraging the brand’s role in the FIFA World Cup partnership in the coming year,” says Jhangiani

Of the remaining Blue Chip Tequilas, four are above a million cases. Proximo’s 1800 is at 2.05 million cases. The 100% agave brand has roughly doubled in size since 2014. Heaven Hill’s Lunazul is another growth story, with the brand at 94,000 cases in 2014 before rocketing to 1.74 million cases by the end of last year. Campari’s Espolòn and Suntory’s Hornitos are also above

1 million cases, with the former reaching 1.58 million and the latter 1.56 million cases last year.

Rounding out the Blue Chip Tequilas are a trio of brands approaching the million-case mark. The largest, Bacardi’s Cazadores,

reached 924,000 cases last year, after nearly quadrupling over the last decade. William Grant & Sons’ Milagro grew to 811,000 cases in 2024, with the brand accelerating over the last five years, with an average growth rate of 22.5% between 2019 and 2024. Finally, Brown-Forman’s El Jimador hit 771,000 cases, roughly doubling over the last decade.

American Whiskey Success

Within the remaining Blue Chip whiskies, seven are from the U.S., along with one Canadian and one Scotch whisky. Heaven Hill’s Evan Williams reached 3.05 million cases in 2024. The accessibly-priced Bourbon has added over a million cases since 2014, averaging 8.4% growth from 2014 to 2019 and 1.8% since then. Elijah Craig, also owned by Heaven Hill, is one of the newly minted Blue Chip brands, reaching 541,000 cases last year. “We’re seeing a migration from ultra-premium to premium and super-premium tiers, driven by what we call smart indulgence,” says Susan Wahl, vice president of American whiskey at Heaven Hill Brands. “People still want to treat themselves, but they’re prioritizing quality and meaning over excess.”

Maker’s Mark, Suntory Global Spirits’ largest Blue Chip Brand, was at 2.23 million cases in 2024, capping a decade of growth that saw it add just under 1 million cases. In recent years Suntory has ramped up innovation for the brand, adding new releases such as Cellar Aged, a wood finishing series, and, earlier this year, Star Hill Farm, a new wheat whiskey.

Diageo’s Bulleit and Campari’s Wild Turkey return to the Blue Chips list, with both brands above 1 million cases in the U.S. Bulleit, the larger brand, reached 1.67 million cases in 2024, averaging 17% growth from 2014 to 2019 and 3.2% from 2019 to 2024. In the last decade, the brand has branched out into both higher-end releases and RTDs. Most recently, Bulleit added a bottled Whiskey Sour cocktail. Campari’s Wild Turkey added more than 300,000 cases over the last decade, reaching 1.29 million cases in 2024. The brand has found success not only with its flagship releases, but with high-end limited editions as part of the Master’s Keep series. Beacon, the final release in the series, is a blend of 10- and 16-year-old Bourbon, selected by master blender Bruce Russell and master distiller Eddie Russell.

The final million-case whiskey brand is Ole Smoky’s line of Tennessee whiskeys and moonshines. The brand, including flavors, grew to 1.22 million cases in 2024, from a base of 222,000 cases in 2014. Ole Smoky’s success has been driven by its consistent stream of new flavors and offerings that range from Apple Pie Moonshine and whiskey-infused Pickles to creambased offerings. Ole Smoky recently named industry veteran Mike Novy as CEO. Novy succeeds Robert Hall, who has served in the role since 2016 and will remain with the company to assist with the executive transition before retiring.

Sazerac’s Buffalo Trace, a first-time Blue Chip Brand, winds down the American whiskeys on the list. Over the last decade, the brand has grown from 114,000 cases to 600,000 cases, with supply from the distillery consistently increasing. Often constrained by availability issues, Sazerac has greatly expanded production capacity for Buffalo Trace in the last few years, giving the brand plenty of runway in the future.

The two remaining whiskies—one from Canada and one from Scotland—are Proximo’s Pendleton and Diageo’s Buchanan’s blended Scotch. The Proximo brand, a returning winner, grew to 506,000 cases last year, showing a steady rise from 2014, when it was at less than 200,000 cases. Buchanan’s, the larger brand, was at 710,000 cases last year, growing by 300,000 over the last decade. Diageo embraces innovation with Buchanan’s, including flavored releases like 2023’s Buchanan’s Pineapple and, more recently, with Buchanan’s Green Seal, a new upscale addition to the portfolio. The new whisky is bottled at 40% abv and, according to the company, includes never-before-released single malt from Glen Elgin, as well as experimental stocks and whiskies aged in ex-Bourbon barrels.

Spirits Diversity

The remaining Blue Chip spirits brands cover vodka, gin, rum, and liqueurs, with Sazerac’s Platinum 7X vodka the largest. The perennially growing brand was at 2.2 million cases in 2024 and underwent a significant period of expansion from 2014 to 2019 when it doubled in size from 800,000 to 1.6 million cases. Heaven Hill’s Deep Eddy—at 1.73 million cases in 2024—saw even more rapid growth in the early years of the last decade. Between 2014 and 2019 the brand went from 455,000 cases to 1.4 million cases.

Gin’s sole Blue Chip Brand is William Grant & Sons’ Hendrick’s, the leading super-premium gin in the U.S. The brand, which has led the charge in upscale gin since its launch, was at 615,000 cases last year, more than doubling in size since 2014. Similarly, rum is represented by one brand, Pernod Ricard’s Malibu. Last year, Malibu was at 2.8 million cases, just under 1 million cases more than in 2014.

Two liqueurs, Campari’s Aperol and Sazerac’s 99, earned Blue Chips. The Campari brand, boosted by growing demand for Spritz cocktails in the U.S., was at 37,000 cases in 2014. In the last decade, Aperol has grown nearly 20-fold, reaching 604,000 cases in 2024. Meanwhile 99, another steady grower, reached 515,000 cases in 2024, more than doubling from 2014. Portfoliomate Buzzballz also made the grade at 1.7 million cases.

California Wine Stalwarts

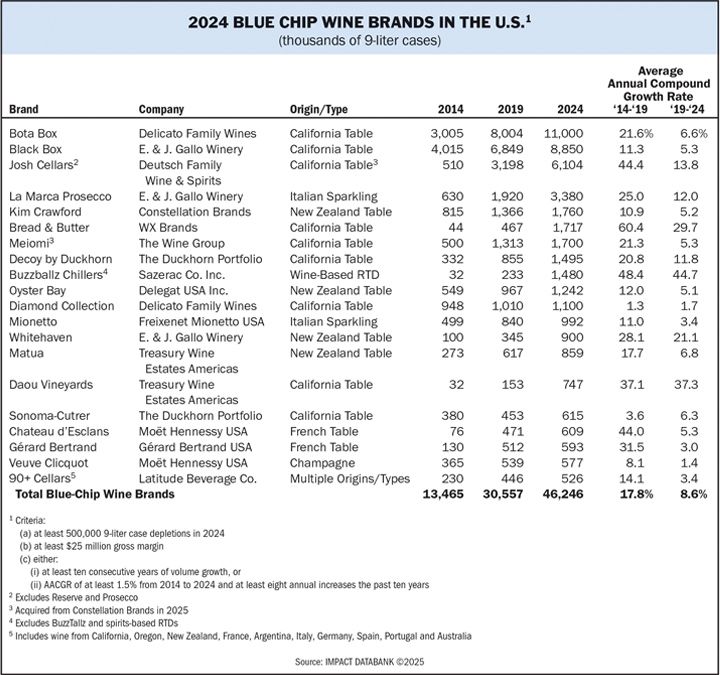

The Blue Chip wine list includes 20 brands spanning a variety of origins, formats, and price segments. The market-leading California wine category accounts for nearly half the list with nine members of the honor roll, while New Zealand logged four entries, France is represented with three labels, and Italy fielded two. Rounding out the list is a wine-based cocktail and a multi-origin brand.

The Blue Chips wine roster is led by two boxed wine behemoths, Bota Box from Delicato Family Wines and Black Box from Gallo. The two brands now combine for 20 million cases between them, with Bota Box about 2 million cases larger than its rival. Most recently Bota Box has seen growth propelled by its Mini and Breeze offshoots in the 500-ml. and better-for-you segments, respectively.

“The U.S. market’s mass adoption of small formats comes as today’s wine and spirits industry is catching up to the non-alcoholic beverage industry, which has long offered small formats as a norm in sodas, waters, and teas,” Delicato CMO Jon Guggino told Impact earlier this year. “Bota Mini cartons are lightweight and shatterproof and are just immensely more convenient than 750-ml. glass bottles overall. Second, the 500-ml. format is attractive to consumers who are moderating their alcohol intake, as it offers inherent portion control.”

Fellow California juggernaut Josh Cellars is the third-largest Blue Chip wine, with depletions above 6 million cases—excluding its Reserve and Prosecco offerings—and U.S. retail value approaching $1.2 billion. Last year, the Deutsch Family Wine & Spirits brand found new growth drivers in its recent innovations Seaswept White Blend and Hearth Cabernet Sauvignon. Those two entries combined for nearly 400,000 cases last year, and have been successful at expanding Josh into new drinking occasions, according to Dan Kleinman, Deutsch Family’s chief brand officer. “Both wines were built to address a white space in the wine category and expand the occasions where Josh Cellars shows up,” says Kleinman. “The Seaswept and Hearth innovations are examples of how Josh Cellars continues to stand out in the crowded market by welcoming in a new kind of wine drinker.”

Higher up the pricing ladder in the California category, The Duckhorn Portfolio has two Blue Chip brands in Decoy by Duckhorn and Sonoma-Cutrer. Decoy by Duckhorn is the sixth-largest table wine brand in the U.S. in retail value terms within the $10-and-up segment at more than $400 million. Decoy has added more than a million cases to its total over the past decade, and last year extended with a Featherweight Sauvignon Blanc in the better-for-you category. Portfoliomate Sonoma-Cutrer, acquired from Brown-Forman in a deal that closed last year, boosted Duckhorn’s presence in Chardonnay and has grown to above 600,000 cases in the U.S. Earlier this year, Duckhorn, with 2024 sales of $475 million, noted in an interview with Impact that it would amp up focus on Duckhorn Vineyards, Kosta Browne, Decoy, and Sonoma-Cutrer, along with Goldeneye, Calera, and Greenwing, which combine for 96% of its net sales.

Treasury Wine Estates has likewise made gains in the $20-and-up California segment via its Daou brand, which had volume of 747,000 cases in the U.S. last year and has continued to rise in 2025, propelled by its Daou Discovery tier, which is now the leading Cabernet above $20 in the U.S. market, according to the company. Daou Discovery Paso Robles Sauvignon Blanc is another growth driver, having reached 82,000 cases last year and recently earning Impact “Hot Prospect” honors. Treasury’s Matua brand from New Zealand is also among the Blue Chips, now approaching 900,000 cases in the U.S.

Novato, California-based WX Brands, owned by Argentina’s Bemberg family, continues to see rapid growth from its Bread & Butter label, which has U.S. retail value of more than $300 million on 1.7 million case depletions. Bread & Butter is up by double-digits in retail channels so far this year, extending a run in which it’s tacked on more than 1.2 million cases to its total in the past half-decade.

Meiomi, the former Constellation brand that recently moved to The Wine Group’s portfolio, has seen better trends this year and has increased The Wine Group’s presence in the above-$15 segment. “The recent trends on Meiomi have turned positive, and we expect to take the brand to the next level,” The Wine Group CEO John Sutton recently told Impact. Meiomi had U.S. retail value of over $500 million last year, ranking third after Josh Cellars and Stella Rosa among all table wines priced above $10 a 750-ml.

Also playing in the premium-and-up tier is the Coppola Diamond Collection, owned by Delicato. With volume of 1.1 million cases in the U.S. last year, the brand has seen consistent growth in recent years as Delicato has backed it with prominent above-the-line campaigns, landing it on the Blue Chip roster.

A Bright Spot For Prosecco

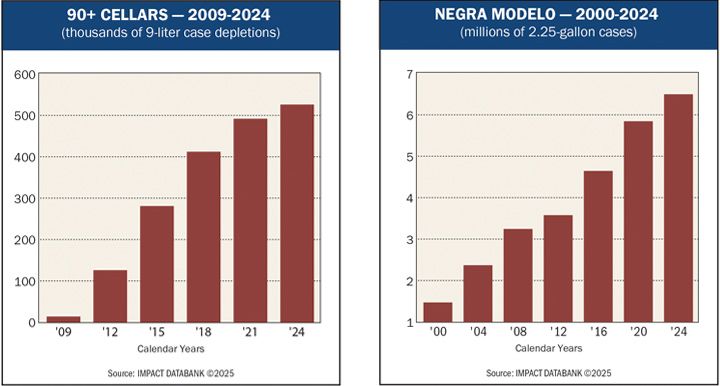

Boston-based Latitude Beverage joined the ranks of Blue Chip marketers with its 90+ Cellars brand, which sources from both domestic producers as well as a host of countries around the world. 90+, with offerings retailing from $11-$35 a 750-ml., has more than doubled in size to above a half-million cases in the past decade. About 80% of the brand’s volume is in imports.

Prosecco is a strong performer for 90+ Cellars, with Latitude founder and president Kevin Mehra calling it a bright spot for the brand this year and 90+’s largest SKU. According to Impact Databank, 90+ Prosecco was up 12% to roughly 160,000 cases last year, with its Prosecco Rosé rising 6.4% to 27,000 cases. “We are seeing some growth in our white wines,” Mehra says. “We have a new Cremant in our portfolio that’s doing really well.”

Prosecco leader La Marca from Gallo is also among the BlueChip Brands. Despite its increasingly enormous base—now some 3.4 million cases—La Marca has averaged 12% growth over the past five years, with Gallo aggressively expanding the brand out of its retail stronghold into new channels and occasions, including on-premise placements both by-the-glass and in cocktails.

La Marca has continued to show impressive gains at retail this year (selling around $16 a 750-ml.) even within a challenging market. The brand’s retail value now registers approximately $700 million annually. “La Marca Prosecco is now a top ten beverage alcohol SKU,” Gallo chief commercial officer Britt West recently told Impact. “That shows the continued consumer interest in sparkling at particular price points. It’s connecting with the target consumer.”

Second-ranked Prosecco player Mionetto likewise earned Blue Chip accolades after a decade which saw it nearly double in size. This year, Mionetto is poised to cross the 1-millioncase mark in the U.S., with the brand showing solid gains in retail channels in the year-to-date.

Also representing the sparkling contingent is Moët Hennessy-owned Veuve Clicquot, the leading Champagne brand in the U.S. market. Veuve Clicquot, with U.S. retail value of $450 million, is second only to La Marca among all sparkling wines. Veuve Clicquot La Grande Dame 2018 and La Grande Dame Rosé 2015 are among the brand’s most recent prestige-level launches. Newer offerings like Veuve Clicquot Rich Rosé are also contributing to growth. “Rich Rosé launched last fall and is designed to be served over ice, helping

introduce Champagne to new audiences and occasions,” says Scott Bowie, senior vice president of Champagne and

sparkling at Moët Hennessy.

Global Wine Appeal

Moët Hennessy earned another Blue Chip with Provence’s Chateau d’Esclans, which leads the U.S. Rosé category. “A bottle of wine such as Whispering Angel (lead item in the d’Esclans portfolio) has a price point that remains crucial to maintaining steady growth in today’s uncertain economy,” says Paul Chevalier, vice president at Chateau d’Esclans. “The recent rise of costs of goods and inflation certainly had an impact on sales two years ago, as prices jumped by $4 or $5 in some cases on the shelf. But as that has stabilized, we’ve seen the brand’s loyal following return.”

Fellow French honoree Gérard Bertrand is also among the leading contenders in the Rosé category with wines such as Cote des Roses and Gris Blanc. But the brand’s namesake vintner from the Languedoc oversees an array of properties through the south of France from his base in Narbonne at Château l’Hospitalet, which operates a 2,500-acre vineyard and luxury hotel. Each of Bertrand’s 17 estates are farmed biodynamically.

Constellation Brands’ market-leading New Zealand entry Kim Crawford returns to the Blue Chip list after more than doubling in size over the past ten years to approach 1.8 million cases. Kim Crawford has enjoyed traction with its lower-alcohol Illuminate wine, and more innovation could be on the way. “We’re looking at zero alcohol,” Sam Glaetzer, president of Constellation’s wine and spirits division, recently told Impact Newsletter. “We’ve had the lower-alcohol Illuminate out there for a while. It’s been doing really well, but we’re seeing some interest in zero and we are still working out how Kim could participate in that.”

Kim Crawford is joined by fellow kiwi brands Oyster Bay and Whitehaven. While Oyster Bay has seen steady gains over the long-term to surpass 1.2 million cases, Whitehaven has picked up speed in the past five years, more than doubling its volume, with 1 million cases in reach for this year.

From the wine-based cocktail segment, Sazerac-owned Buzzballz Chillers qualified as a Blue Chip, having ascended to nearly 1.5 million cases in a decade on the market. Buzzballz also features spirit- and malt-based expressions, allowing the brand to play across a variety of trade channels, including the convenience segment, in markets around the country.

Imports, FMBs Dominate Beer

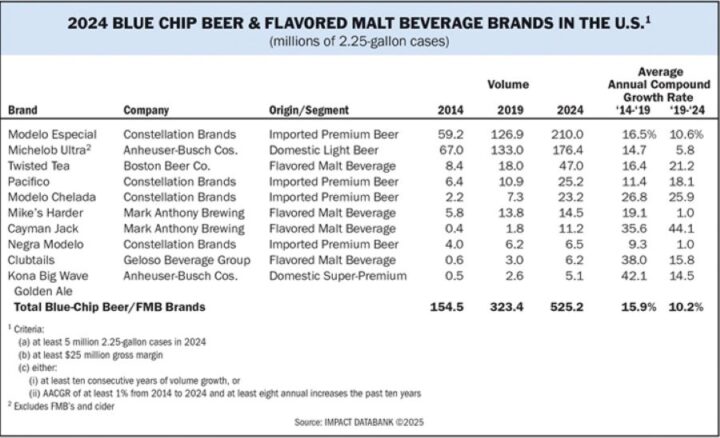

Ten brands from the beer and flavored malt beverage category met the Blue Chip list’s criteria based on their 2024 performances,

with Mexican imports and flavored malt concoctions predominating among the winners. Emblematic of long-term trends in the beer industry, Mexican brews from the Constellation Brands portfolio lead the way among Blue Chip beers, accounting for four slots on the list.

Modelo Especial currently ranks second to Bud Light in the beer market overall in volume terms at 210 million cases, according to Impact Databank, but the brand has quickly been closing the gap. Constellation Brands has warned, however, of weaker sales this year for its Mexican portfolio owing to the sluggish economy, with the effects more dramatic among its core Latino consumers. Despite the headwinds, two other offerings from the Modelo stable, Modelo Chelada and Negra Modelo, also achieved Blue Chip status. Modelo continues to be supported by its “Mark of a Fighter” ad campaign, while a new effort for Chelada, tagged “Bring the Sabor,” launched last year. The Modelo franchise, as well as that of Corona, is likely experiencing some cannibalization from fast-growing stablemate Pacifico, also a Blue Chip. Indeed, Pacifico overtook Modelo Chelada as the fourth-largest imported beer last year, as volume surged 22% to 25.2 million cases.

Anheuser-Busch InBev (A-B InBev) fielded two Blue Chip awardees this year with Michelob Ultra and Kona Big Wave Golden ale. Michelob Ultra has continued to gain popularity with American drinkers in recent years, now ranking fourth among all beer brands in the market by volume and overtaking Miller Lite last year on 5% growth. The brand has made additional headway so far this year, but it has a ways to go in catching third-ranked Coors Light. “Our focus is always on our consumers and ensuring that we continue to invest and innovate in growing segments to meet their needs,” says A-B InBev chief commercial officer Kyle Norrington, on Michelob Ultra Zero, the recent line extension to Michelob Ultra.

Boston Beer-owned Twisted Tea is the largest flavored malt beverage to make the Blue Chips list, having expanded by 21% annually over the last five years to reach 47 million cases. Boston Beer now has a one-two punch in the growing hard tea category, with Twisted Tea joined by the spirits-based Sun Cruiser brand, which has gotten off to a fast start, surpassing 700,000 cases in its debut last year and continuing to soar in 2025.

Mark Anthony Brands is represented by the Mike’s Harder and Cayman Jack FMB labels. While Mike’s Harder has seen growth slow some over the past half-decade, Cayman Jack has exploded, averaging 40% volume gains annually to arrive at 11 million cases. Clubtails, the FMB from Geloso Beverage Group, has also kept up a rapid pace, doubling in size to more than 6 million cases since 2019