Since taking the helm as chairman of the Pennsylvania Liquor Control Board (PLCB) in 2015, Tim Holden has led his team forward with store modernization, digital advertising and marketing, and e-commerce improvements. Pennsylvania is the U.S. market’s second-largest control state by spirits sales, and the largest among control states that are sole wholesalers of wines within their geographical boundaries. “Competition is real, and we’re taking it seriously,” Holden says. “Gone are the days of being the only game in town, and we’re striving to be a destination retailer offering customer service, product selection, and experiences not available anywhere else.”

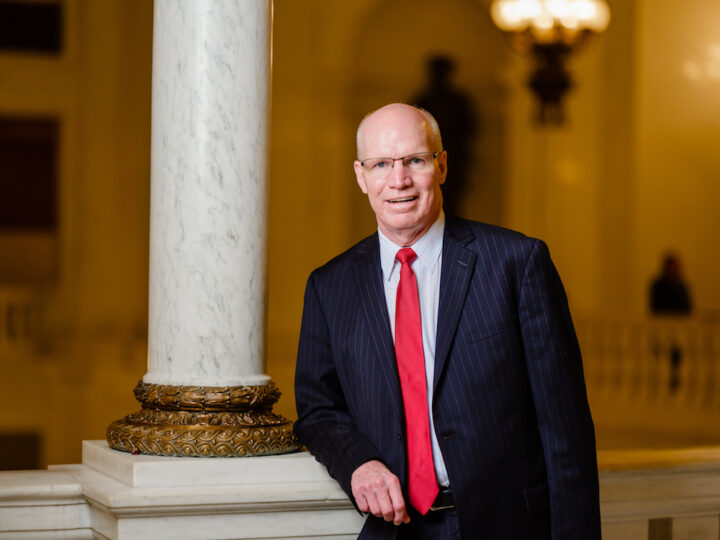

The modest, soft-spoken Holden is a seasoned political veteran who served his Pennsylvania district in the House of Representatives for 20 years from 1993-2013. This experience serves him well, as he oversees the operations of the nation’s largest beverage alcohol retail system. “Given our network of more than 580 retail stores, we have the luxury of experimenting with various store formats, layouts, merchandising strategies, and checkout flows in small pilots to test their receptiveness and success before implementing them broadly,” Holden says. “Our retail philosophy centers on a few key values: customer service, continual improvement, collaboration, and innovation.”

Under Holden’s leadership, retail spirits sales in Pennsylvania eclipsed $1 billion in fiscal 2016-17 and on-premise wine sales have nearly doubled from $140.4 million in fiscal 2015-16 to $278.9 million in fiscal 2018-19. For his team leadership, commitment to modernizing Pennsylvania’s retail tier, and dedication to both customers and employees, Tim Holden has been named a 2020 Market Watch Leader.

Big Picture

A lifelong resident of St. Clair in northeastern Pennsylvania—the state’s coal region—Holden reflects that, as a younger man, he never saw himself as a congressman or chairman of the PLCB. “I was hoping to be a state representative,” he says. “My congressman retired at a time that was really good for me.” Holden served on the House Agricultural Committee for all 20 years of his congressional tenure, the Transportation Committee for 16 years, and the Government Oversight Committee for four years. His ability to work with others and to focus on the big picture made him a valuable leader.

Holden was first nominated to the PLCB by former Gov. Tom Corbett in 2013, and named PLCB chairman by Gov. Tom Wolf in 2015. He’s been a board member of the National Alcohol Beverage Control Association (NABCA) since 2015.

Pennsylvania’s beverage alcohol sales have experienced steady growth under Holden’s leadership. Retail dollar sales of spirits in Pennsylvania increased 4.6% in fiscal 2019 to $1.07 billion, according to the PLCB. Spirits volume increased 2.9% in calendar 2019 to 7.9 million cases, according to Impact Databank/NABCA. And overall spirits sales—including on-premise—increased about 5% to $1.42 billion. While retail wine sales decreased 2.4% in fiscal 2019 to $800 million, on-premise wine sales increased 13% to $278.9 million, and overall wine sales were up 1% to approximately $1.08 billion, according to the PLCB.

Before the Covid-19 pandemic swept over the U.S., the PLCB was on course to break its sales record set last year. Gov. Wolf, however, closed all PLCB retail and online sales for the last two weeks of March. “We had to adjust,” Holden says. “We went from shutdown to expanding our e-commerce, which was never intended to be our sole source, to curbside, then to reopening our stores.”

The PLCB created and implemented a never-before-considered curbside pickup program on April 20 with a limited launch as a response to the Covid-19 crisis. Over the next several weeks, more stores were added, and customers responded. “From just April 20-May 31, we processed over 1 million curbside orders for $69.76 million,” Holden says. By the time this summer kicked into gear, the PLCB’s retail tier was once again firing on all cylinders, including online sales and curbside pickup, with retail sales increasing 15.4% during July and August.

While curbside pickup sales have slowed down from their peak this spring, they are now an important element of the PLCB’s retail business model. Between June 1 and August 31—a span of 92 days—PLCB retail operations processed about 150,000 curbside orders totaling $9.51 million. “We’re taking technology and operational steps to support the new elevated level of online sales,” Holden says.

Retail Modernization

PLCB stores range in size from under 1,000 square feet in rural areas to about 18,000 square feet in urban locations, with the average store size at approximately 5,200 square feet. And Holden has overseen dramatic changes to the PLCB’s retail operations, including enhanced layouts, designs, signage, and p-o-s systems. “Store projects will vary by location, but we want every customer to walk into a Fine Wine & Good Spirits store that is inviting and appealing,” he says.

Under Holden’s leadership, the PLCB is accelerating efforts to renovate the remaining stores in its network that need to be modernized, and he’s also growing the number of Premium Collection stores in Pennsylvania. “With more than half of our stores renovated within the last eight years, our goal is to have all of our stores renovated or refreshed within about the next year and a half,” he says.

In 2019, the PLCB began installing Taste & Learn Centers in some of its Premium Collection stores. “These are in-store spaces dedicated to delivering unique tasting and educational experiences for customers,” Holden says. “Limited seating allows our employees, winemakers, master distillers, professional chefs, and product ambassadors to interact with guests in a private, controlled environment conducive to learning.”

As for his staff, Holden has poured significant resources into employee education. “Since we have hundreds, if not thousands, of products in each store, we have enhanced wine and spirits training programs for employees,” Holden says. “We want our clerks to learn about these products and actively help customers select them, so education will remain a key focus.”

Extensive Network

Across the PLCB’s retail network and distribution centers, there are nearly 18,500 wine SKUs (about 70% are luxury wines carried at the larger Premium Collection stores) and nearly 5,800 spirits SKUs, including about 1,400 luxury spirits. “We also offer tens of thousands of special-order products that we don’t carry in inventory but make available to customers and licensees from suppliers,” Holden says.

The PLCB’s product pricing ranges from $4 a 750-ml. of Evan Williams Egg Nog to $12,000 for the 1989 Macallan 21-year-old Cask No. 3247 single malt Scotch. The least expensive wine is Richards Wild Irish Rosé ($4 a 750-ml.), while the most expensive wine is the 2013 Domaine Coche-Dury Corton Charlemagne Grand Cru ($4,000). The PLCB started to intensify its focus on e-commerce even before the Covid-19 public health crisis unfolded. “The pandemic has delayed our plans to introduce a completely redesigned website, but work on it continues, now with the benefit of the recent experience we gained facing technological and fulfillment challenges due to overwhelming demand for online shopping,” Holden says.

When considering sites for new units, the PLCB looks for convenient locations with easy access and plentiful parking. Stores are often located in popular shopping centers, near big-box retailers. Other factors include demographics, growth and real estate trends, reports from PLCB personnel, and proximity to other PLCB stores.

The PLCB originally employed a counter-service model, where customers would walk in, tell a clerk behind the counter what they wanted, and wait for the clerk to retrieve the products. Recent developments sparked by the Covid-19 pandemic have conjured up some déjà vû. “Ironically, when instituting our curbside pickup program during the pandemic, we returned to counter service in a way,” Holden says.

Discretionary Dollars

As the state’s primary retailer of wine and spirits, the PLCB’s two main goals are to provide a wide selection of products at fair prices and to make significant contributions to Pennsylvania’s coffers. While the PLCB is the state’s only spirits retailer, beer and wine retailing competition is intensifying. There are more than 1,200 retailers licensed to sell wine to-go, 1,300 licensed direct wine shippers, 1,200 beer distributors, and about 1,000 breweries, wineries, and distilleries throughout the state. “All of these companies are competing for consumers’ discretionary dollars,” Holden says. “With so many options for beverage alcohol in Pennsylvania—many of them new within the last four years—we’re working to differentiate ourselves and offer unique customer experiences that keep people coming back into stores.”

One competitive PLCB strategy is to promote an attractive selection. “When selecting monthly special programs and online-only offers, we consider the product mix, sale price, seasonality, sweepstakes (if offered), and any holidays around which customers would purchase wine and spirits for celebrations,” Holden explains. “For flash sales, the main drivers are the supplier-provided discount, cost of product in neighboring markets, and average unit sales. We want products to be popular enough that customers will make a special trip to our store or place an online order.”

Long-Term Trends

While it’s difficult to make a long-term prediction, Holden notes some trends are likely to continue, including curbside service and social distancing. Limited in-store shopping will continue, as will modified store hours to ensure efficient sanitizing and restocking time.

Customers and employees will continue to wear masks and practice social distancing, guided by signage throughout the stores that also encourages them to refrain from touching products unless they intend to buy them. “Since the pandemic, we’ve seen tremendous growth in e-commerce sales, but as we’ve reopened stores to retail sales, we’ve seen a subsequent drop in demand for online,” Holden says. “We anticipate online sales will continue to be popular—probably be more popular than they were pre-pandemic.”