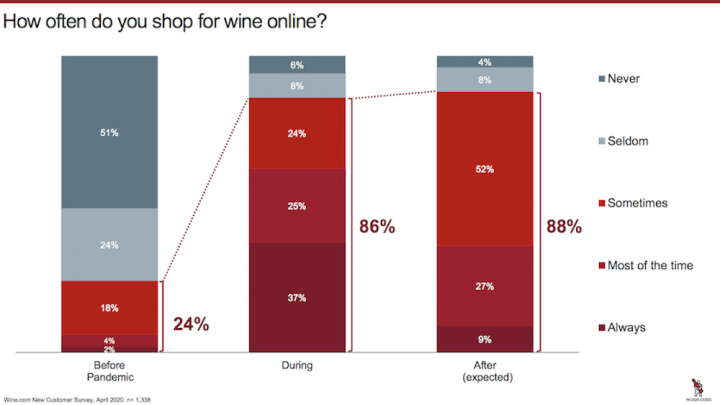

The long-term impact of the Covid-19 pandemic on consumer buying habits may be the final push online beverage alcohol sales need to become mainstream. After two decades, online wine sales are now cruising in the e-commerce fast lane for American consumers. “The pandemic has closed the awareness and education gap for beverage alcohol e-commerce,” says Rich Bergsund, CEO of Wine.com. “This should help propel growth in our sector going forward as consumers try and are delighted by online services.”

Booming retail beverage alcohol sales since the beginning of March have been well publicized. But nothing comes close to the online buying frenzy, with beverage alcohol e-commerce sales increasing 234% from March 7-April 18 as compared to the same period last year, according to Nielsen.

Wine dominates online beverage alcohol sales, and perhaps no company was better positioned for the boom than San Francisco-based Wine.com. Over that five-week time period, Wine.com’s wine sales volume was up 325% with growth moving into overdrive at 450% in April, with the company selling nearly 19,000 different SKUs. “We quickly scaled our operations and customer care teams to meet the influx of demand,” says Bergsund. “Since March, we’ve hired 500 people and implemented new warehouse protocols to keep our people safe.” From a much smaller base, Wine.com spirits sales in California, New York, Florida, and New Jersey have been growing even faster than wine, according to Bergsund.

Wines under $20 have grown share at Wine.com, but the company is growing up to 200% growth through the $100 price point. “Tied to growth at lower price points is a disproportionate growth in white wine,” Bergsund notes. “Domestic wines have also gained a bit of share over imports.”

These developments came on the heels of a growth trajectory of 20% in January and February. “While we’re seeing tremendous growth across all demographics, it’s been strongest among Gen-Zers and millennials,” Bergsund says. “The average price per bottle has dropped from $30 to $23, and customers are ordering just as many bottles at a time—and more frequently.”

Other beverage alcohol retailers selling wine online have experienced similar price point trends. “We’re selling more under-$20 wine than we have ever sold before,” says Daniel Posner, owner of Grapes The Wine Company in White Plains, New York. “People are definitely drinking California Cabernet Sauvignon and adventuring into trying new wines from Burgundy and beyond.”

While online wine sales overall have exploded since March, not all online wine retailers have experienced growth. Posner says his business was down about 35% during the March 7-April 18 time period. “Hopefully state legislatures see the need to loosen restrictions on shipping into their states from out-of-state retailers,” Posner observes. “Consumers during this time have been totally reliant upon the internet for ordering and many of their local wine stores are not equipped, and have been exposed for having very poor selections.”

Despite recent breakthroughs, there’s still much works that needs to be done to continue the evolution of online beverage alcohol sales nationwide. “American wine consumers should not be limited because of these factors,” Posner says. “The world is at their fingertips and that ought to include wine.”