Each year, Market Watch sister publication Impact Newsletter salutes the best performing wine, spirits, and beer brands in the U.S. market over the long term with its “Blue Chip Brands” honor roll. The challenges of the past year and a half have certainly created new business dynamics—accelerating some areas of the market while hampering others—but, as the Blue Chips roster shows, many of the industry’s major players remain at the top of their game. To meet Impact’s Blue Chip criteria, brands must show at least ten consecutive years of volume growth, or average annual compound growth of at least 0.5% from 2010 through 2020 with positive growth in at least eight of those ten years. In addition, the brands must have maintained gross margins of at least $25 million last year.

This year’s Blue Chip roster features a total of 71 brands, including 31 spirits, 28 wines, and 12 beers. In spirits, the ongoing growth of whiskies and Tequilas has vaulted a number of brands onto the list, and kept growth strong for Blue Chip labels like Crown Royal, Jim Beam, Patrón, and Jameson, among others. The wine contingent remains dominated by California offerings, augmented by a growing range of Italian brands, especially of the sparkling variety. Meanwhile, the Blue Chip beers feature a range of styles, from light beers like Michelob Ultra through imports such as Modelo Especial and flavored malt beverages like Mike’s Harder.

Spirits Remain Strong

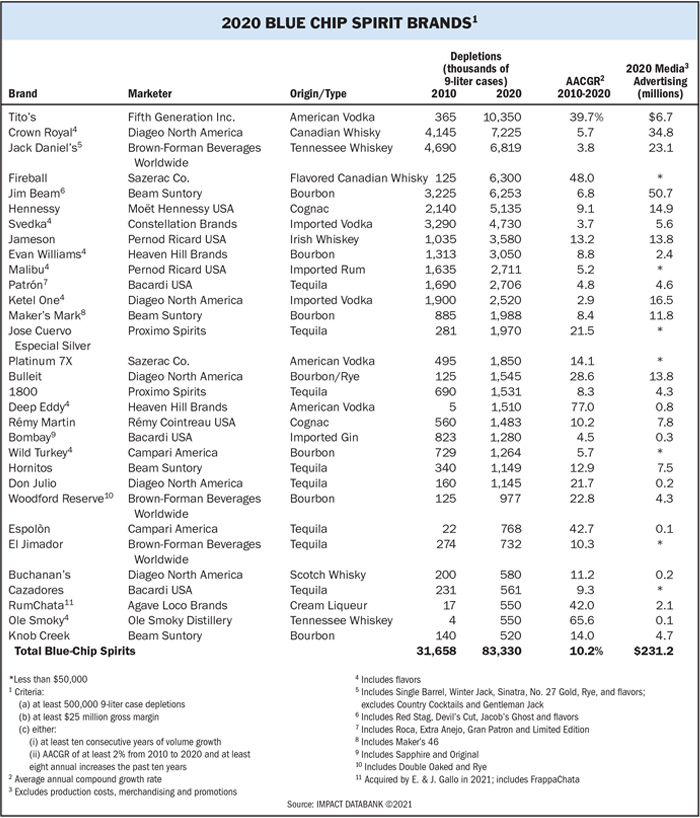

For 2020, 31 spirits brands earned Impact Blue Chip honors, up from 27 last year. After a strong 2020 for the spirits world, all of last year’s brands returned, with four new ones—including representatives from the buoyant Tequila and American whiskey categories—earning the honor for the first time. While a variety of categories are represented among Blue Chip brands, this year’s list is led by whiskies and Tequila, which make up 21 of the winners. While whiskies of various kinds account for a little less than half of the overall list, Tequila, with eight Blue Chip brands, is the single largest category represented. Tito’s Handmade Vodka is the largest Blue Chip brand at over 10 million cases. The vodka, now the largest spirit brand in the U.S., has averaged nearly 40% growth per year over the past decade. The single-SKU brand has reshaped the American vodka market, driving consumers to a slightly higher price-point than its closest competitor, Smirnoff. While Tito’s is already the largest spirit in America, brand parent Fifth Generation still sees ample runway for growth. “We believe we have a lot of room to grow both from a consumer and market standpoint,” says vice president of trade marketing Frank Polley. “We see a lot of upside growth with our current consumer base, as well as opportunities to invite new consumers to try Tito’s vodka.” Despite Tito’s massive surge in the last decade, the brand’s ad spend is relatively limited at $6.7 million—far less than many of the brands chasing it.

Four other vodka brands earned Blue Chip status for 2020. Constellation Brands’ Svedka is now at roughly 4.7 million cases. Since 2010, the Swedish brand has added around 1.5 million cases through innovative offerings. In the last two years, the brand has launched a rosé vodka, a line of lower alcohol and calorie flavored spirits, and, most recently, a line of 8% abv RTDs under the Svedka Vodka Sodas banner. Constellation says it plans to widen distribution of Svedka’s RTD cocktails in the future. Ketel One, retailing in vodka’s super-premium tier, also made the Blue Chips list, reaching 2.5 million cases last year. The Diageo brand has been a leader in vodka innovations over the last decade, launching its lower-calorie Ketel One Botanical offerings in 2018, ahead of many of its competitors. The brand is also present in the spirits-based RTD segment with its Botanical Vodka Spritzes, which take the three Botanical flavors—Peach & Orange Blossom, Cucumber & Mint, and Grapefruit & Rose—and offer them in more convenient packaging for consumption. Rounding out the vodka category on this year’s Blue Chips roster are Sazerac’s Platinum 7X at 1.85 million cases and Heaven Hill Brands’ Deep Eddy at just over 1.5 million. Deep Eddy, a corn-based vodka like Tito’s, made its debut as a Blue Chip brand this year, averaging 77% growth over the last decade.

With eight Blue Chip brands, Tequila is now ascendant on the honor roll. Seven of the eight winners are made from 100% blue agave, showcasing the increasing sophistication of the American Tequila drinker as well as the focus on more premium products from marketers. Bacardi’s Patrón, at 2.7 million cases, is the largest Blue Chip Tequila brand and also one of a few luxury-priced brands to make the list. While Patrón maintains a considerable lead on its competition, it’s not the only luxury-priced Tequila to earn a Blue Chip nod for 2020. At over 1 million cases and averaging roughly 20% growth for the last ten years, Diageo’s Don Julio easily made the Blue Chips list, showing that consumer interest in high-end Tequilas now goes well beyond a single strong brand. Diageo CEO Ivan Menezes recently addressed the forward-looking growth prospects for Tequila in the U.S., noting plenty of room for upwards growth in the category. “If you look at Nielsen sales, Tequila is about 20% of spirits in California,” he says. “A lot of the country is still sitting at about 10% or lower. This trend has a lot to run with and what we’re really excited about is it’s happening at the higher end. Our growth rate is double the growth rate of the Tequila category because the acceleration is happening at the high-end price points.”

Proximo’s Jose Cuervo Especial Silver is the lone Blue Chip mixto Tequila. The brand has added 1.7 million cases since 2010 and is on the verge of crossing the 2-million-case mark. Proximo also owns the third-largest Blue Chip Tequila, 1800. The brand, a 100% blue agave Tequila offered at a slight premium compared to Jose Cuervo, has found tremendous success as consumers reach for higher-quality Tequilas at all price points. Last year, 1800 crossed 1.5 million cases. Proximo will come under new leadership at the end of the year, with Cuervo veteran Luis Félix set to replace the retiring Mike Keyes as president and CEO. At roughly 1.15 million cases, Beam Suntory’s Hornitos is the fourth-largest Blue Chip Tequila. The super-premium brand, like 1800, has seen its audience expand as Tequila gained momentum over the last ten years, adding 800,000 cases. Behind Hornitos are Campari America’s Espolòn at 768,000 cases, Brown-Forman’s El Jimador at 732,000, and Bacardi’s Cazadores at 561,000 cases.

Whiskies, taken as a whole, lead the way for this year’s Blue Chip brands and, while American whiskies stand out, global categories like Irish whiskey, Scotch, and Canadian whiskies are all represented. The largest Blue Chip whisk(e)y is Diageo’s Crown Royal Canadian whisky at over 7 million cases. The brand, the second-largest spirit on the list overall, has seen its growth bolstered by its flavored offshoots, with releases like Apple, Vanilla, and Peach bringing new consumers into the fold. All the while, Diageo has stoked interest at the high end of the category with more limited, extra-aged offerings, and yearly releases. Jack Daniel’s Tennessee whiskey and its flavored offshoots reached 6.8 million cases last year and will likely cross the 7-million-case mark in 2021. Like Crown, Jack has expanded its audience through flavored releases while also drawing in collectors and affluent consumers with its single barrel expressions. Though Jack Daniel’s is the Blue Chips list’s perennial Tennessee whiskey, this year a new Tennessee brand also made the cut. Ole Smoky Distillery’s namesake brand made its debut as a Blue Chip brand this year, reaching 550,000 cases and averaging 66% growth over the last ten years.

Bourbon is well represented on this year’s Blue Chips list, with seven brands appearing. Beam Suntory’s Jim Beam leads the way at 6.25 million cases, thanks to a portfolio that includes many flavors and branded offshoots like Jim Beam Black. Jim Beam has averaged impressive annual growth of 6.8% from its large base over the past decade. Behind Beam is Heaven Hill’s Evan Williams. A mainstay among affordably priced whiskies, Evan Williams was at just over 3 million cases last year, rising at a rate of 8.8% annually since 2010.

While the two leading Blue Chip Bourbon brands come in at more affordable price points, Bourbon, like Tequila, is seeing widespread premiumization. The third-largest brand, Beam Suntory’s Maker’s Mark, retails in the super-premium tier and will almost certainly cross 2 million cases in 2021 after reaching 1.99 million last year. Other super-premium Blue Chip Bourbon brands include Diageo’s Bulleit at 1.55 million cases, Brown-Forman’s Woodford Reserve at 977,000 cases, and Beam Suntory’s Knob Creek at 520,000. With further growth expected for Bulleit, Diageo recently opened a new carbon-neutral distillery in Kentucky, said to be one of the largest of its kind in North America, on a $130 million investment. It has capacity of 10 million proof gallons annually. Campari America’s Wild Turkey, which offers a variety of whiskies that straddle the premium and super-premium price tiers, also earned a Blue Chip nod this year. The brand reached 1.26 million cases last year, adding roughly 500,000 cases since 2010.

Though the bulk of the Blue Chips whiskies come from the Bourbon category, imports like Scotch and Irish whiskey are also among the winners. Scotch is represented by Diageo’s Buchanan’s, which last year reached 580,000 cases. In Irish whiskey, Jameson, the dominant leader in the category, was at nearly 3.6 million cases for 2020. While the Covid-19 lockdowns of 2020 hit Jameson particularly hard, as they occurred around St. Patrick’s Day, the brand has bounced back in 2021. Finally, one single-SKU flavored whisky made this year’s Blue Chips list: Fireball. Sazerac’s wildly popular cinnamon-flavored whisky remained a Blue Chip brand, reaching 6.3 million cases and averaging 48% growth between 2010 and 2020.

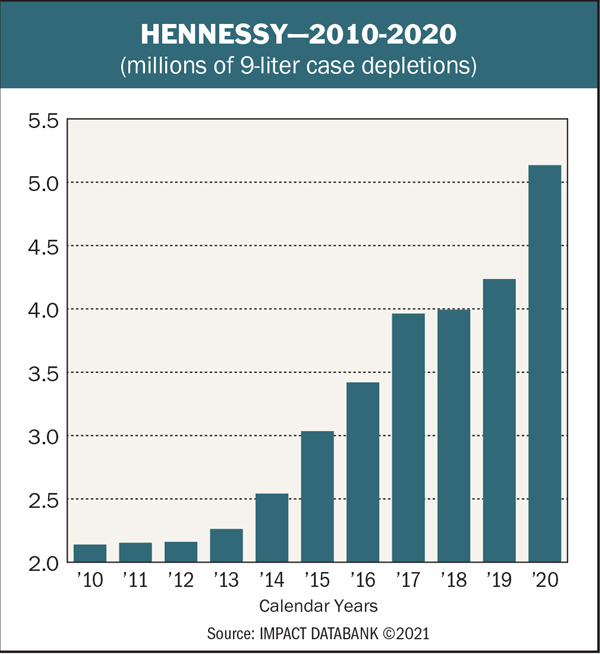

While whiskies, Tequilas, and vodkas account for the lion’s share of this year’s Blue Chip brands, other categories are well represented, with two Cognacs, one rum, one imported gin, and one cream liqueur making the grade. Hennessy, the largest Cognac and sixth-largest brand on the list overall, is one of a handful of billion-dollar brands in the U.S. And despite supply challenges last year, the brand reached 5.1 million cases, making up over 60% of the Cognac market in the U.S. Since 2010, Hennessy has more than doubled in size in the U.S. Behind the Moët Hennessy giant is Rémy Cointreau’s Rémy Martin Cognac at just under 1.5 million cases for 2020. The brand has tripled in size in the last decade and, barring any unforeseen challenges, will easily cross 2 million cases in the years ahead.

Pernod Ricard’s Malibu is the lone rum to earn Blue Chip honors, having added more than 1 million cases in the last decade. The 2010s were a period of experimentation for the brand and saw numerous line extensions including early entry into the RTD market with Malibu Rum Cans and popular flavor extensions like Malibu Pineapple. Malibu’s RTD cocktail offshoot earned an Impact “Hot Prospect” award earlier this year.

On this year’s Blue Chips list, gin is represented by category stalwart Bombay. The Bacardi brand, including both its original gin and popular Sapphire offshoot, was at nearly 1.3 million cases last year, averaging 4.5% growth over the last decade. Like many of the other brands to earn a Blue Chip nod, Bombay has recently entered the spirits-based RTD world with Bombay Sapphire Gin & Tonic. Finally, the lone cream liqueur to make the grade is RumChata. The Agave Loco brand reached 550,000 cases last year after averaging a 42% growth rate for the previous decade and was acquired by E. & J. Gallo earlier this year for an undisclosed sum.

Domestic And Imported Wines Shine

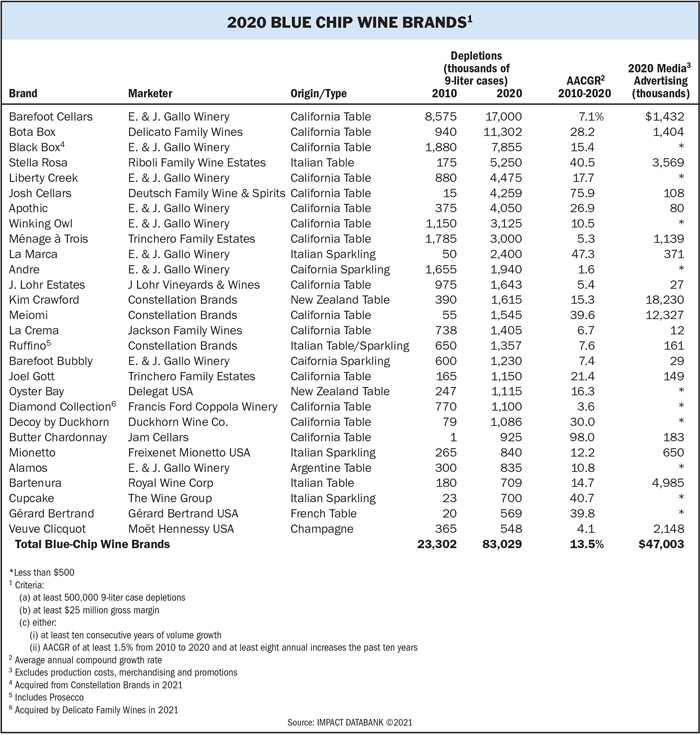

While California table wines make up over half of the Blue Chip wine list this year, bottlings from Italy, New Zealand, France, and Argentina are gaining on their American counterparts. Sparkling wines, too, are abundant on this year’s Blue Chip wine list, represented mainly by Prosecco, but rounded out by domestic sparklers and a single Champagne. For yet another year, E. & J. Gallo’s Barefoot Cellars holds the No.-1 Blue Chip position, with 17 million cases depleted in 2020 and a 10-year average annual growth rate of 7.1%. Barefoot has benefited from a wide array of packaging options, as well as from various line extensions. Portfolio-mate Barefoot Bubbly is also a returning Blue Chip, after registering slightly higher 10-year growth of 7.4% and reaching 1.23 million cases in 2020; the brand was at just 600,000 cases in 2010. Fellow Gallo brand André is a newly minted Blue Chip this year in another direct nod to the lasting strength of value-priced domestic sparklers. While André’s growth over the past ten years hasn’t been astronomical, it has remained steady; from a base of 1.65 million cases in 2010, the wine is now nearing the 2-million-case mark with 1.94 million cases depleted in 2020.

Prosecco dominates the sparkling Blue Chip brands, with Italian brand La Marca—also from Gallo—leading the way. La Marca is joined by Freixenet Mionetto USA’s Mionetto Prosecco and The Wine Group’s Cupcake Prosecco, which is new to the list this year. Constellation’s Ruffino and Royal Wine Corp’s Bartenura also include Proseccos. While Prosecco’s growth has been explosive for some years now thanks to the continuing popularity of sparkling wine, producers have kept the category fresh in recent years by promoting Prosecco rosé, which was finally approved as a formal DOC by the Prosecco DOC Consortium in 2020. Over the past ten years, La Marca has grown an average of 47.3%, building up from just 50,000 cases in 2010 to 2.4 million cases in 2020. While the other sparklers haven’t been quite as hot, their average growth rates over the past decade were also substantial, with Ruffino’s portfolio up 7.6% to reach nearly 1.36 million cases last year; Mionetto rising 12.2% to 840,000 cases; Bartenura jumping 14.7% annually in the past decade to 709,000 cases; and Cupcake snowballing 40.7% a year to reach 700,000 cases in 2020. Veuve Clicquot, the sole Champagne Blue Chip, benefited from strong consumer recognition in the off-premise over the course of the pandemic. “We saw a rapid rebound in sales toward the end of 2020 and early 2021, and we’re still experiencing growth as consumers continue to enjoy Champagne at home while exploring on-premise purchasing opportunities as well,” says Anne-Sophie Stock, vice president of Moët & Chandon and Veuve Clicquot at Moët Hennessy. Veuve Clicquot has seen 10-year average gains of 4.1% to reach 548,000 cases last year.

As in recent years, super-premium table wines also have a strong presence on the 2020 Blue Chip wine list. California brand Josh Cellars, from Deutsch Family Wine & Spirits, has sustained incredible average growth of nearly 76% in the last ten years, putting the brand across the 4-millioncase mark last year. Deutsch CEO Peter Deutsch says Josh’s growth can be attributed to what he refers to as simple elegance. “It’s a $15 wine that looks like a $30 package,” he adds. J. Lohr Vineyards & Wines’ J. Lohr Estates, another California label, does the brunt of its volume in the $10-$12 range, but has focused on premiumization in more recent years, debuting J. Lohr Signature Cabernet ($100 a 750-ml.) and the Pure Paso ($35) proprietary red blend. Last year, the brand hit 1.64 million cases; in 2010, it depleted just under 1 million cases.

On California’s Sonoma Coast, both Constellation and Jackson Family Wines are present with super-premium Blue Chip brands. Since purchasing Meiomi from Copper Cane Wines & Provisions in 2015 for $315 million, the brand has continued its steady upward growth, culminating in surpassing 1.5 million cases last year; the label has grown an average of 39.6% annually in the past decade. Jackson Family Wines, meanwhile, has focused on cool climate Chardonnay and Pinot Noir with its Sonoma County-based La Crema label, which has had average annual compound growth of 6.7%, reaching 1.4 million cases last year. The brand has focused on more high-end offerings as of late through its Wines of Distinction Collection, which retails at $45-$65. A Willamette Valley Pinot Noir ($30) is now also in the La Crema offering.

Also in the super-premium California space are Francis Ford Coppola Winery’s Diamond Collection, a new addition to the Blue Chip list this year, and Duckhorn Wine Co.’s Decoy by Duckhorn, which has been red hot in recent years and was named the 2020 Market Watch Leaders wine brand of the year. The Diamond Collection retails in the $20 range, and features a variety of wines sourced from across California. In the past ten years, the brand has grown at a steady average of 3.6%, leading it to 1.1 million cases in 2020. The Coppola Winery was acquired by Delicato Family Wines earlier this year. Duckhorn’s Decoy—the entry level label within the company’s luxury portfolio—has a wide variety of Napa and Sonoma-sourced wines that retail in the $25- $30 range. The brand has attracted a wide variety of consumers seeking to enter the Duckhorn sphere; while it was at just 79,000 cases in 2010, the brand surpassed 1 million cases in 2020. Rounding out super-premium California Blue Chip wines is Butter Chardonnay by Jam Cellars, which has capitalized on the American consumer’s love for rich, buttery iterations of the varietal. Selling just 1,000 cases in 2010, Butter is now nearing the 1-million-case mark, with an astronomical ten-year average growth of 98%.

There are plenty of domestic Blue Chip brands that are in the below-$10 range as well, including Bota Box and Black Box, the No.-2 and No.-3 Blue Chip brands, respectively. Both brands benefit from the alternative packaging surge of the moment, with boxed wine making over its reputation to the benefit of major growth. Bota Box, in particular, has slightly premiumized its lineup with the release of Nighthawk, a bolder, richer offshoot than the flagship range. Overall, Bota Box now sits at 11.3 million cases—up from 940,000 cases a decade before—while Black Box depleted 7.9 million cases last year, on ten-year average annual compound growth of 15.4%. The remaining domestic Blue Chip wines are E. & J. Gallo brands Liberty Creek, Apothic, and Winking Owl; as well as Trinchero Family Estates brands Ménage à Trois and Joel Gott.

Outside of the U.S., New Zealand Sauvignon Blanc remains a driving force for Constellation’s Kim Crawford and Delegat USA Inc.’s Oyster Bay. The former has sustained steady growth of 15.3% in the past decade and depleted 1.62 million cases last year, while the latter had slightly higher average annual compound growth of 16.3%, hitting 1.1 million cases in 2020. France is represented in Blue Chip wines by Gérard Bertrand, whose eponymous brand depleted 569,000 cases last year, upon ten-year average growth of nearly 40%. There’s also one Argentinian wine—Alamos by Gallo— that’s a newly minted Blue Chip this year. The brand saw depletions of 835,000 cases last year, growing 10.8% annually in the past ten years. The final international Blue Chip is Riboli Family Wine Estates powerhouse, Stella Rosa. The Italian brand has grown an average of 40.5% in the last decade, culminating in 5.25 million cases in 2020.

Beer Keeps Chugging Along

Impact’s Blue Chip Beer and Flavored Malt Beverage (FMB) list represents heavy hitters from across the industry. Overall the 12 honorees depleted 450.6 million cases in 2020, three times the size the same set of brands collectively accounted for in 2010 when they combined for 152.3 million cases. Over the past decade the Blue Chip brands have achieved an average annual compound growth rate of 11.5%; some standout labels among them have maintained figures above 15%, with one above 30%. Four labels—Blue Moon Belgian White Ale, Dos Equis Lager, Keystone Light, and Tecate Light—dropped off the list having failed to sustain high enough growth rates. Leading the field once again is Anheuser-Busch InBev’s (A-B InBev) Michelob Ultra, which reached 148.9 million cases in 2020. It led the way on ad spend as well, with A-B InBev backing the brand to the tune of $120.9 million. Starting from a base of 46.8 million cases in 2010, Ultra achieved an average annual compound growth rate of 12.3% as consumers gravitated toward its health-conscious messaging and 95 calories a bottle.

Three other A-B InBev products received Blue Chip honors in addition to Michelob Ultra: Stella Artois, Bud Ice, and Bud Light Chelada. No.-3 ranked Stella grew at a rate of 9.2% over the past decade as it added 19.1 million cases to reach 32.5 million cases last year. As the only imported super-premium label among the Blue Chips, it’s one of the most valuable brands on the list, particularly on a per-case basis, reflected in its $28 million ad spend. Fourthranked Bud Ice was at 25.8 million cases last year on minimal advertising, giving A-B InBev three of the top four spots on the list. Bud Light Chelada, which rose to 7 million cases on 3.7% growth over the past decade, was backed by just under $1 million worth of advertising last year.

While the hard seltzer boom is still too young to factor into Blue Chip rankings, several trailblazing forebears are included as Blue Chip brands. Boston Beer Co.’s Twisted Tea ranks first among Flavored Malt Beverages and No.-6 overall, growing from 4 million cases in 2010 to 18.5 million cases last year, supported by nearly $10 million in media outlay. Twisted Tea has since been joined by Truly Hard Seltzer in Boston Beer’s FMB portfolio, but the brand’s annual compound growth of 16.4% is a testament to Twisted Tea’s staying power. While Truly has grown at a dizzying pace over the last few years, Boston Beer flagged significant softening in the hard seltzer category in a recent earnings report, throwing into question whether it will ever ascend to Blue Chip status. Constellation likewise cited slowing conditions in the hard seltzer category in its most recent earnings report, issued in early October.

Also honored among FMBs are Mike’s Hard Lemonade offshoot Mike’s Harder and Fifco USA’s Seagram’s Escapes. Mike’s Harder increased its volume nearly five-fold over ten years, growing from 3.5 million cases to 15.7 million last year on average annual compound growth of 16.1%. Seagram’s Escapes nearly matched that growth rate as it rose at an average annual compound rate of 14.9%, rising from 3.1 million cases in 2010 to 12.4 million cases last year.

Constellation Brands’ Mexican imports continued to pay dividends for the company last year with three brews from south of the border achieving Blue Chip status. No.-2 overall was Modelo Especial, which tacked on more than 100 million cases over ten years, reaching 144.5 million cases in 2020. Its average annual compound growth rate was also the second best, at 16.5%. Modelo Especial saw 16% depletions growth in the three months through August. With over $90 million in advertising, Modelo Especial is the only rival to Michelob Ultra both in volume and advertising dollars.

Much smaller, Negra Modelo, a Munich Dunkel-style lager, reached 5.8 million cases on 5.9% average annual compound growth and $23.3 million in media buys. “In 2019, we made our biggest-ever investment in marketing support behind Modelo,” says Greg Gallagher, vice president brand marketing for Casa Modelo. “And in the two years since unveiling the campaign we’ve seen an incredible 50% increase in general market drinkers.” Also from Constellation, Pacifico has gone from 5.1 million cases to nearly 12.3 million cases on impressive 9.2% annual growth. It similarly has received a major marketing push in recent years via its “Live Life Anchors Up” campaign, which senior director, brand marketing for Pacifico Alex Schultz said “brought new consumers to Pacifico and helped increase distribution.” That campaign accounted for an additional $21 million in advertising last year.

Both Molson Coors and Heineken saw two brands drop off the list, leaving them with one apiece. For Molson Coors that was Coors Original, a Canadian version of Coors Banquet, which was at 20 million cases on a minimal advertising budget. Heineken’s 2017 acquisition of Lagunitas Brewing Co. looks even better in hindsight as Lagunitas remains on the Blue Chip list even as Dos Equis and Tecate dropped off. The national craft brand had far and away the highest average annual compound growth rate over the last decade, growth 34%. It went from 400,000 cases to 7.2 million cases during that span.