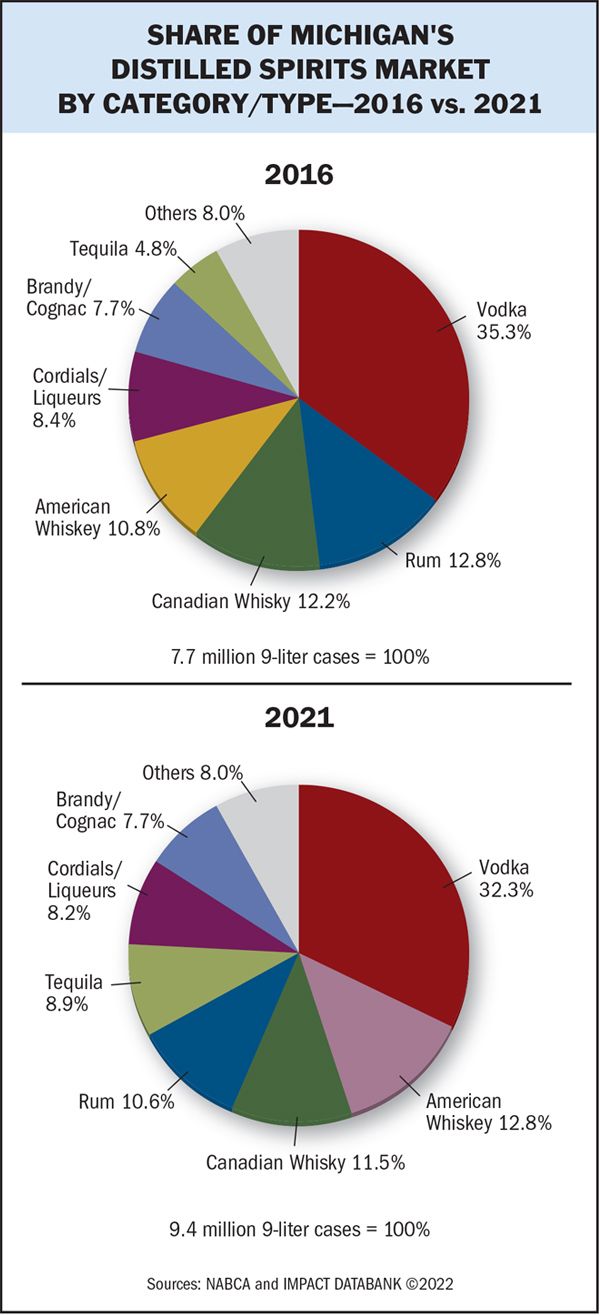

Supply chain issues didn’t keep spirits down in Michigan last year. The largest control state for spirits in both dollar sales and case volume embraced trading-up trends as total spirits sales increased 4.2% to $2.16 billion on a 0.3% decrease in volume to approximately 9.39 million 9-liter cases, according to Impact Databank and the National Alcohol Beverage Control Association. “When you see the demand for high-end Bourbons, Cognacs, Tequilas, and Scotch whiskies, it tells me that people are trading up because there is quite a demand,” says Pat Gagliardi, chairman of the Michigan Liquor Control Commission. “All of the out-of-stock demand in Michigan has been normally in high-end items.”

Indeed, spirits sales growth in Michigan could have been higher last year if supply had met demand. “We’ve been dealing with out-of-stocks, especially in high-end areas where we could have made more money. That happens when there is great demand,” Gagliardi says. “We would have been up more than 10% last year if we had all the stock we needed to meet demand, but we still had a great year.”

Michigan easily leads all control states in total spirits volume and dollar sales. While dipping 0.3% last year, Michigan spirits volume is still up 953,000 cases, or 11.2%, since 2019. Michigan’s spirits sales are $415 million greater than those of No.-2 Ohio. By case volume, Michigan leads Pennsylvania, No.-2 in volume, by about 670,000 cases.

Growth Leaders

Only three of the top-ten selling spirits brands in Michigan increased volume last year. The other seven brands decreased in case volume. Tito’s ($20 a 750-ml.) the top-selling spirits brand in The Wolverine State, increased 4.8% in 2021 to 537,000 cases. “The Tito’s 375-ml. ($10) does very well,” Gagliardi says. “What we see is vodka is still the king in Michigan.”

Ranked last year as the fourth-largest spirit by volume in Michigan, Fireball ($15 a 750-ml.) posted the highest growth rate among the state’s top-10 spirits brands at 7.1% to 333,000 cases. “Fireball has just been amazing,” Gagliardi says. “It sells well in the 50-ml. ($1) and the 350-ml. ($8) sizes. With Fireball, it’s the smaller sizes that seem to do better, but we do sell a lot of 750-mls. A lot of people take the smaller size bottles with them for outdoor activities like golf and fishing, and they’re easy to pack away. It’s a nice way for people to measure their consumption. That’s one of the reasons why our 50-mls. are so popular.”

Among the top-ten spirits brands by volume in Michigan, there were five white spirits and five brown spirits. In all, three vodkas ranked among the top-selling spirits brands in Michigan in 2021. Following Tito’s at No. 1, Smirnoff, ($13 a 750-ml.) ranked No. 2 in Michigan, decreased 4.1% to 379,000 cases. Ninth-ranked New Amsterdam vodka ($13 a 750-ml.) declined 6.4% to 197,000 cases.

Tenth-ranked Jim Beam Bourbon ($20 a 750-ml.) inched up 1.6% in Michigan last year to 151,000 cases and was one of the three top-ten spirits brands to grow. In all, there were four whiskey brands among the top-ten selling spirits brands in Michigan last year, as Jim Beam and Fireball were joined by sixth-ranked Crown Royal ($28.96 a 750-ml.), down 0.5% to 254,000 cases; and seventh-ranked Jack Daniel’s ($25 a 70-ml.), down 4.8% last year to 239,000 cases.

The top-ten in Michigan also included two rum brands. Third-ranked Captain Morgan Spiced Rum ($12 a 750-ml.) decreased 5.1% to 345,000 cases, while fifth-ranked Bacardi Superior ($13 a 750-ml.) declined 4.2% to 265,000 cases. Bacardi Superior was also popular in the 1.75-liter ($23) and 375-ml. ($6.49) formats. Hobbled by supply chain woes, Hennessy VS Cognac decreased 15.7% in Michigan in 2021 to 227,000 cases. This letdown came on the heels of tremendous 42.9% growth in 2020 to 270,000 cases.

In other action last year, legislation was passed in Michigan allowing beverage alcohol with 13.5% abv or below, including spirits based RTDs, to be handled by the state’s beer and wine wholesalers. “A lot of people have gravitated to RTDs because there is less tax on the segment,” Gagliardi says.

Destination State

Tourism is a significant contributing factor to Michigan’s spirits growth. “Michigan is such a big tourism, hospitality, and entertainment state,” Gagliardi says. “A lot of people from all over the upper Midwest come to Michigan, or own property here because we sit in the middle of the Great Lakes. Once we re-opened in July, August, and September 2020, people went crazy. Michigan was busy with tourism in October like it was the middle of the summer.”

Whether it’s Motown attractions or access to the Great Lakes and abundant beaches and forests, tourists flock to Michigan throughout the year and momentum continued in 2021. “After being cooped up and worried, people really came out,” Gagliardi says. “Midwesterners decided they didn’t have to travel around the world to find a place to vacation. It really helped Michigan’s tourism industry tremendously. As we went into last year, it never fell off. The economy was doing better than expected. There were more jobs developed than even reported on a month-to-month basis.”

Michigan’s tourism industry is esti- mated at $17.2 billion a year. “We’re not selling to just the 10.2 million residents of Michigan,” Gagliardi notes. “The whole of the upper Midwest comes here during different parts of the year. We are a playground, so to speak. We have a lot of additional people that we are selling products to.”

Tourism has also helped the on-premise in Michigan begin to recover. “At this time last February, we were down to a quarter of capacity. It took a little bit of a toll,” Gagliardi says. “Outdoor service took off even in the cold weather months because we have a large outdoor recreation community here even in the winter months for snowmobiling, skiing, and ice fishing. People put up tents and yurts and they really took off. The outcome was people really handled it well.”

Gagliardi says Michigan’s big spirits inventory is also a plus for visitors. “Luckily in Michigan we have so much to offer. There was an understanding that we had certain high-end Cognacs, Scotches, and Tequilas that no one could get,” Gagliardi says, adding that Michigan had at least some supply of most major products and categories, unlike many neighboring states.

Updates On The Horizon

One of the Michigan Liquor Control Commission’s top priorities this year is to replace its outdated computer product order- ing software for its approximate 12,000 on- and off-premise customers. “Our ordering system right now is on 45-year-old software,” Gagliardi says. “There’s one person in state government who can handle our software. Whatever we put in place has to be prepared to last a long time.”

Michigan officials were looking to replace the software in 2019, but then the Covid-19 pandemic hit and priorities changed over- night. “We’re just finishing up with the requests for proposals and hopefully we’ll soon get bids on the new system,” Gagliardi says. “Everything at the state government level moves much slower than the private sector. Of course, Covid-19 also got in the way. It’s taken a lot longer than expected.”

The Liquor Commission is working on getting the new software with the state’s Department of Technology and Department of Management and Budget. “We have an opportunity here to do some good stuff, and we’re hoping there is enough money to squeeze out an upgrade of our present licensing system,” Gagliardi says. “We’re hoping to get a couple of birds with one stone.”

The Michigan Liquor Control Commission is also the state’s spirits wholesaler, and it uses three associate distributors to ware- house and deliver spirits statewide. “We operate as a wholesaler just like the private sector,” Gagliardi says. “We’re business-people running a business. Our metrics are all about numbers.”

Republic National Distributing Co. is partnered in Michigan with National Wine and Spirits as one distributor, and they’re joined by Great Lakes Distributing and Imperial. “The distributors have to be able to deliver to any licensee in the state once a week,” Gagliardi says. “The licensee gets it delivered free if it’s the minimal order of a case. You can order a split case of spirits without paying the split-case fee like you would with wine.”

Inventory Management

Michigan Liquor officials are also looking to improve inventory management. “Last year we got up to almost 13,000 SKUs in our price book,” Gagliardi says. “We cleaned up our system and got it down to closer to 10,500. We’re trying to get to around 10,000 because that’s the best area for inventory management.”

Many SKUs are no longer relevant and need to be removed from the inventory list. “We were able to whittle that down and take off product codes that are no longer applicable because we don’t have the product,” Gagliardi says.

Among other developments, all of Michigan’s Liquor Control Commission’s 12,000 customers registered online for business last year. “Just a year ago, we were able to get all of our licensees online,” Gagliardi says. “You have to be online to order from our system now. All of our licensees have to use electronic fund transfer to order though our system. There’s no more cash and check when you get a product delivered.”

As long as public safety remains a priority, Gagliardi anticipates steady growth for Michigan’s spirits sales. “The future is wide open. We need to continue to make safety a priority. Drink responsibly. Enjoy what we have. Try a new product,” he says. “We’ve had tremendous growth in business hours, in products, and in days we sell. The future is pretty bright.”