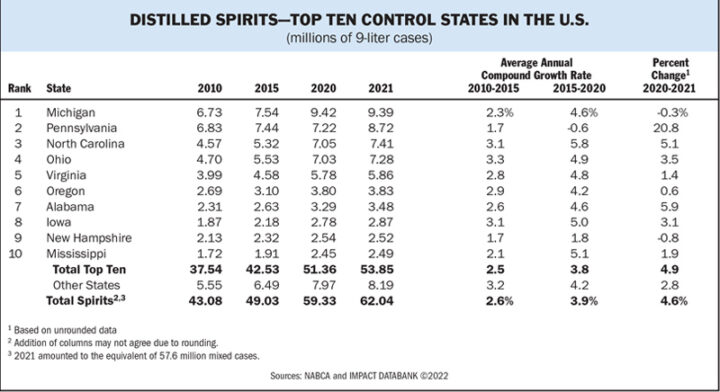

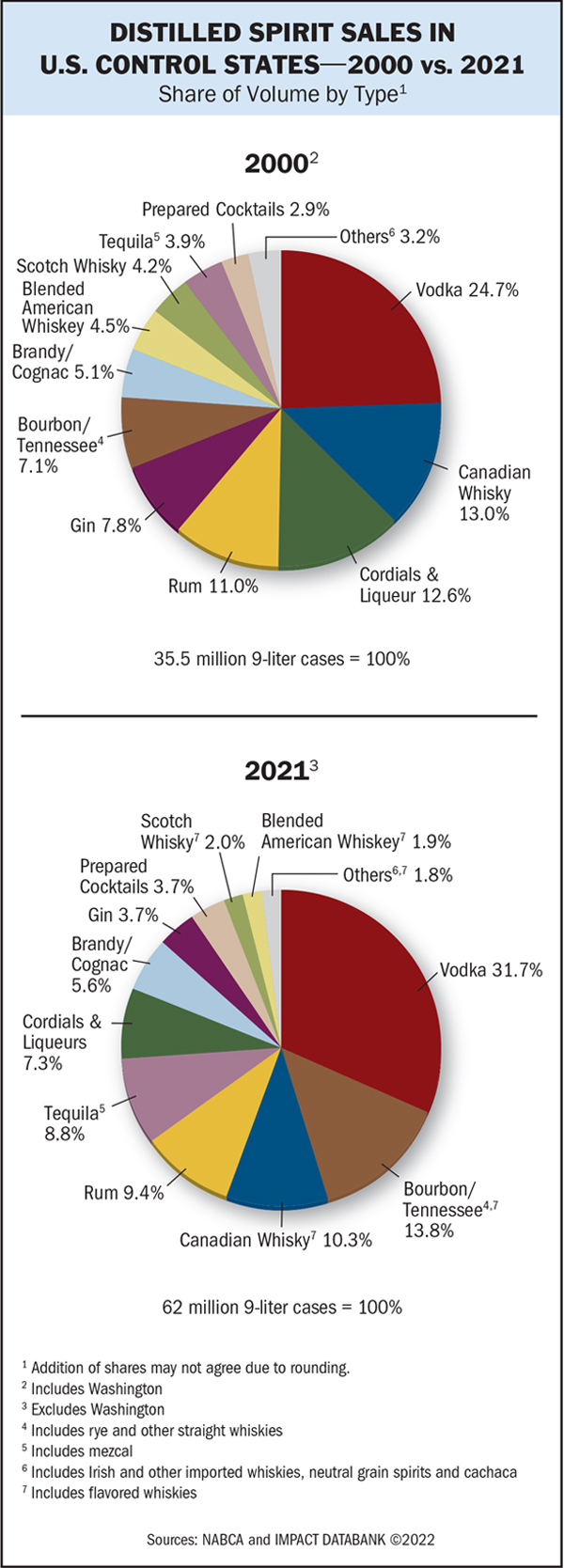

Spirits sales in the nation’s 17 control states gained further momentum last year on the heels of the historic 2020 Covid-19 sales surge. The powerful growth of super- ($24-$40 a 750-ml.) and ultra-premium (over $40 a 750-ml.) spirits brands fueled dollar sales, which rose 9.8% on a 4.6% volume gain, according to the National Alcohol Beverage Control Association (NABCA) and Impact Databank. “People are trading up significantly,” says NABCA senior vice president of trade relations David Jackson. “People are drinking higher-quality spirits. The greater the price, theoretically, the healthier the market.”

The restocking of the on-premise last year brought significant beverage alcohol growth after the shutdowns of 2020. But as the drinks industry continues to recover from the pandemic, supply challenges persist. “There’s going to be a continued shortage of truck logistics, and shortages of Tequila,” Jackson says. “Nobody can forecast Tequila’s growth. The problem is agave plants take six years to mature.” Bourbons also face supply issues. “The holdup with Bourbon is that it has to be aged a minimum of four years in oak,” Jackson adds. “Unless somebody is going to forecast 10% growth—and nobody did—it creates a challenge.”

Rising gas prices and inflation fears are also stoking economic concern. “Inflation has us worried since so much spirits growth overall is in premiumization,” says Travis Hill, CEO of the Virginia Alcoholic Beverage Control Authority. “Some consumers might feel they’re getting squeezed at the gas pump and elsewhere.”

Top Priorities

Despite decreasing 0.3% to approximately 9.4 million cases of spirits volume last year, Michigan’s spirits dollar sales increased 4.2% to $2.16 billion. The Wolverine State easily leads all control states in spirits volume and dollar sales. Michigan spirits volume is up 953,000 cases, or 11.3%, since 2019. But sales trends during the Covid-19 era did result in control states rankings shuffling in both dollar sales and case volume. After passing Pennsylvania in 2020 when the Keystone State closed its beverage alcohol retail operations for two months at the beginning of the Covid-19 crisis, Ohio remains No. 3 in total dollars sales, even though Pennsylvania had a full calendar year of uninterrupted sales. Pennsylvania remains the No. 2 control state by case volume but North Carolina surpassed Ohio in volume to claim the No. 3 position in 2020 and held onto it in 2021. The Keystone State’s spirits sales in 2021 increased 25% to $1.24 billion on a 20.8% volume increase to 8.72 million cases. Compared to 2019, the year prior to pandemic store closures, dollars gained 17.2%, and cases were up 10%. “This past year was difficult as we, like most retailers, continued to deal with stock shortages on a wide variety of products,” says Pennsylvania Liquor Control Board (PLCB) Chairman Tim Holden. “That had an impact on the number and type of promotions we ran in 2021.”

Ultra-premium spirits sales in Pennsylvania surged 52.6%, according to Holden, and had the highest growth rate among pricing segments. The PLCB promotes coupons, flash sales, product announcements, and monthly promotions, along with fun lifestyle content through Facebook and Twitter. “We’ve found paid product push ads on Facebook and Instagram to be very effective driving sales to our e-commerce site because we understand our customers are very price- and product-focused,” Holden says.

With convenience and attractive price points bringing in customers, spirits-based ready-to-drink (RTD) cocktails represent tremendous growth opportunities. In Pennsylvania, Fine Wine & Good Spirits retail stores expanded inventory of spirits-based RTDs by 26 SKUs to 172. RTDs in Pennsylvania grew 84.7%, or $20.16 million, to $43.98 million last year. Canned RTDs increased 251.5%, while those not in cans increased 23.8%. Cans in the $5-$10 range increased the most (up 143.9%), more than doubling to $6.3 million over calendar year 2020, Holden says, adding that the RTD category remains a top priority. “To ensure consumers are aware of that growing selec- tion, we’ve provided multiple p-o-s opportunities for our RTD products within stores, from large stack outs to endcaps to dump bins,” he says. “We’ve also allowed limited vendor p-o-s on products we want to highlight.”

Tequila sales in the Keystone State increased 61%, or by approximately $63.64 million, in calendar year 2021. Brands in the $40-$60 range gained the most, adding $26.5 million, a 77.7% increase. Patrón Silver ($53 a 750-ml.) was the top Tequila in Pennsylvania last year with a 42.5% gain to $19.55 million. “Tequila will continue experiencing double-digit growth in its premium price segments,” Holden says. “We expect the resumption of in-store tastings in 2022 and that should lift RTD, Tequila, and all other spirits categories into healthy growth.”

This year, the PLCB expects to open one new store, relocate or expand six stores, and renovate an additional 28 of its 585 current stores. In the last several years, the PLCB has made improvements to 87% of its stores.

Growth Leaders

Among the top five control states by spirits volume, North Carolina posted the second-highest dollar sales growth rate last year at 12.1% to $1.44 billion on a 5.1% volume increase to 7.4 million 9-liter cases. “We continue to see large growth in the whisk(e)y, premium and super-premium Tequila, and RTD categories,” says Jeff Strickland, director of Public Affairs for the North Carolina Alcohol Beverage Control (ABC) Commission.

While the North Carolina ABC Commission doesn’t market or advertise spirits, many of the 171 local ABC Boards use merchandising displays along with market research for product placement in their stores to maximize sales. “Many groups and clubs around the state are active on social media platforms like Facebook, promoting their local ABC boards and stores,” Strickland says. “Monthly special purchases allow supplier rebates, and tasting events held by ABC stores are the largest in-store promotions.”

Tito’s vodka ($23 a 750-ml.) the No.-1 selling spirit in the Tar Heel State, posted the highest growth rate among the state’s top-five selling spirits brands at 19.4% to 344,000 cases in 2021. Smirnoff ($15), the No.-2 selling spirit and vodka in North Carolina, decreased slightly to 281,000 cases. Crown Royal ($35), the third-ranked spirits brand in the state, increased 6.6% to 242,000 cases. Micro-spirits produced in North Carolina grew 21% last year. The top three brands by volume were Blue Shark vodka ($25), Midnight Moon Apple Pie moonshine ($24), and Social House vodka ($40). In other action, the North Carolina General Assembly passed legisla- tion last year making a variety of changes to state alcohol laws, including allowing online orders from ABC stores that would be picked up at the respective store.

Buckeye Buzz

Ohio, the No.-2 control state by spirits sales, posted the second-highest increase in dollar sales at 9.7% to $1.7 billion on a 3.5% volume gain to 7.28 million 9-liter cases. “Whisk(e)y, Tequila, and vodka made up the majority of sales in Ohio,” says Jim Canepa, superintendent of the Ohio Division for Liquor Control (ODLC). “But of note, Tequila saw the greatest growth between 2020 and 2021 in Ohio, with a more than 33% increase in dollar volume compared to 2020.”

In 2021, the ODLC increased its Tequila offerings by 23% to more than 350 Tequila items and also brought in more than 400 single barrels of whisk(e)y. With Bourbon at the helm, American whiskey dollar sales increased 11% in Ohio last year. “My team and I have been focused on bringing new and innovative products into the state,” Canepa says. “We seek out rare, premium, and small-batch bottles so we carry the sought-after products that Ohioans want.”

In total, the Ohio Liquor Control also added 300 new products to its portfolio. “We’re working to provide the best customer experience possible,” Canepa says. On December 15, the e-commerce rule (HB 674) went into effect. The measure allows beverage alcohol retailers, known as liquor agencies in Ohio, to make home deliveries of spirits. Agents who participate must establish an online home delivery process including an auditable delivery tracking system to ensure home deliveries are received and signed for by a legal-drinking-age adult.

Online, Curbside, Home Delivery

With strong trends for online sales, curbside pickup and home delivery, Virginia, the No.-5 control state by spirits sales, experienced a 13.5% gain in spirits sales last year to approximately $1.32 billion. The Virginia ABC works with DoorDash as its partner for same-day delivery. “It’s something we’re going to continue growing,” says Hill. “The demand has come down since the height of the pandemic, but it’s still 700% more than pre-pandemic.”

The Virginia ABC opened a 315,000-square-foot central office and distribution center northeast of Richmond in Hanover County in June 2021. Legislation is pending in the state’s General Assembly for additional investment in ABC e-commerce operations. “This new facility positions ABC to continue to grow spirits sales for decades to come through our brick-and-mortar stores and e-commerce,” Hill says. “ABC plans to invest in e-commerce to focus even greater attention on meeting consumers where they want to shop and how they want to receive their products.”

The Virginia ABC programs all in-store displays to feature prod- ucts aligning with a strategy to increase the average shopper’s basket with more premium bottle purchases. The ABC program pods (four-sided kiosks) showcase all ingredients for a featured cocktail, and “Mini Monday” promotions offer trial of a different product one Monday of each month in 50-ml. bottles. Spirited Thursdays promotions during holidays feature a 20% discount on five-select 750-ml. spirits focused on a category or holiday on Thursdays during the promotion period. Similarly, door busters campaigns feature a 20% discount on ten 1.75-liter bottles focused on a category or occasion. “We also conduct seasonal campaigns through various media and promotional campaigns using social media and in-store displays,” Hill says.

Of the top-five selling spirits brands in Virginia, Patrón Silver ($55 a 750-ml.) posted the highest growth rate at 38.1% to $28.9 million, followed by Hennessy VS, increasing 12.6% to $52.8 million. Tito’s ($22), the No.-1 selling spirit in Virginia, was also up by double-digits with 10.5% growth to $57.9 million. Virginia lawmakers recently extended legislation for cocktails to-go and delivery by two years to 2024.

Mixed Forecast

Although weekly cumulative sales for the fiscal year were up 5% at the beginning of February in Virginia, much lower single-digit growth is expected this year. “While sales growth is ahead of forecast, we have some tough prior year comparable items in the last few months of this fiscal year which, when paired with economic and supply uncertainty, mitigate against further growth expectations,” Hill says.

Nevertheless, the premiumization of spirits is expected to continue, albeit at a slower pace. “We’ve seen consumers aren’t afraid to spend money on quality, experience and the right branding and/or marketing,” Pennsylvania’s Holden says. “We even see long-time legacy brands investing in premiumization by rebranding whole lines of products, changing flavor profiles, introducing new products, changing packaging and increasing pricing to reposition items.”