Each year, Market Watch sister publication Impact Newsletter recognizes its “Hot Prospect” brands: the up-and-coming labels across the drinks business. This year, a total of 99 brands from the wine, spirits, and RTD cocktail categories met Impact Databank’s criteria to make the list. To qualify as Hot Prospects, brands must have achieved at least 15% depletions growth for 2021, while also showing consistent growth in the two preceding years. For spirits, imported wines, and RTDs, brand volumes must be between 50,000 and 200,000 cases, while domestic wines are between 50,000 and 250,000 cases. This year’s class of spirits Hot Prospects draws from 13 different categories, totaling 44 awardees. Given current trends in the spirits world, it’s no surprise that 12 whiskies and seven Tequila brands earned Hot Prospects status. While the Hot Prospects winners offer insight into what’s currently popular with consumers, the list of rising players also previews the categories and brands that are poised to step into the limelight in the years ahead.

Proximo Spirits’ Gran Centenario Tequila is the largest brand on this year’s list, coming in at 193,000 cases. In 2021, the brand jumped 36.5%, and from 2018 to 2020, Centenario averaged roughly 40% growth year-over-year. Just behind Gran Centenario is Patrón Reposado at 181,000 cases. The Bacardi-owned Tequila has nearly quadrupled in size since 2018. All seven of the Tequila brands on this year’s Hot Prospect list are made from 100% blue agave and most fall in the super-premium tier of the market. As Tequila’s popularity has grown in the U.S. over the last few years, consumers are increasingly reaching for higher-priced brands. Following Patrón Reposado is Proximo’s Maestro Dobel. The luxury-priced brand was up 48.4% in 2021 and cracked the 100,000-case mark for the first time.

Beyond consumers trending toward more premium Tequilas, the category has also seen successful celebrity partnerships. The largest of these—like Casamigos and Teremana—are far too large to earn a Hot Prospects nod and have graduated to Hot Brand status, but two celebrity brands made this year’s list. 818 Tequila, founded by Kendall Jenner, earned its first Hot Prospect award by reaching 60,000 cases in its first full year on the market. Cincoro, created by basketball superstar Michael Jordan and other NBA owners, also earned its first award by growing 53.6% last year and reaching 51,000 cases. Both celebrity-backed brands retail well into the luxury price tier. The final two Tequila brands on the list are Milestone Brands’ Dulce Vida, which is known for its flavored offerings and grew 36.7% last year to nearly 100,000 cases and Trinchero’s Tres Agaves, which reached 54,000 cases on nearly 20% growth last year.

Overall, whiskies scored the largest chunk of this year’s Hot Prospects list, with 12 in total. However, when broken down into individual styles, none surpassed Tequila. Bourbon, the largest category within whiskies, landed five winners; followed by Tennessee whiskey and American rye with two each; and Irish, Japanese, and other American whiskey each represented once. While the winning whiskies represent a wider array of prices than the winning Tequilas, they still skew toward the higher-end. The largest Bourbon on this year’s list is Pernod Ricard-owned Jefferson’s at 158,000 cases, up 31.2%. Besides Jefferson’s, Pernod Ricard scored a Hot Prospects win for its American whiskey label TX. The Texas brand shot to 85,000 cases last year. Jefferson’s and TX are both part of Pernod’s new American Whiskey Collective, described by North America chairman and CEO Ann Mukherjee as “a ‘new fashioned’ whiskey portfolio focused on pushing boundaries rather than adhering strictly to tradition.” Pernod also owns Redbreast, the lone Irish whiskey on this year’s list. The pot-still whiskey grew to 56,000 cases last year, nearly doubling in size since 2018.

Nipping at Jefferson’s heels is Beam Suntory’s Maker’s 46, the higher-end offering from the Maker’s Mark brand. Last year, Maker’s 46 grew 15%, surpassing 150,000 cases. Beam Suntory scored another Hot Prospects award with Jim Beam Orange, the only flavored whiskey to earn an award this year. The label reached 90,000 cases in its first year on the market in 2021. In addition to its two Bourbon winners, Beam Suntory’s Suntory Toki was the only Japanese whisky to make the list, growing 25.5% to 122,000 cases.

Another super-premium priced brand to qualify as a Hot Prospect is Campari America’s Russell’s Reserve. The small batch offering from the Wild Turkey distillers reached 72,000 cases last year, up 31.4%. Among rye whiskeys, Deutsch Family Wine & Spirits’ Redemption was the largest Hot Prospect at 111,000 cases, up 22.6%. Brown-Forman landed a super-premium priced rye on this year’s list, with Woodford Reserve Rye making the grade at 65,000 cases, up 22.6%. The company’s Old Forester 100 Proof Bourbon also earned an award, jumping nearly 20% to 61,000 cases. Tennessee whiskeys made a strong showing with two super-premium brands: Jack Daniel’s Single Barrel and the Uncle Nearest portfolio. Brown-Forman’s single barrel offering was the larger of the two at 87,000 cases, up nearly 50%. Uncle Nearest follows closely behind at 80,000 cases on a 31.5% increase.

If this year’s Hot Prospect winners are any indication, rum and gin are on the rise, and vodka drinkers may be reaching for a wider variety of brands. All three of those categories landed six brands on this year’s list. Maison Ferrand’s Plantation is the leading rum brand at 149,000 cases, making it the fifth largest spirit overall. The brand returned to the list for its 2021 performance when it grew by 35%, nearly doubling in size since 2018. Behind Plantation is a flavored offshoot from Diageo’s Captain Morgan Spiced Rum. The brand’s Spiced Apple release earned its first Hot Prospect for its 2021 performance, when it jumped from 45,000 cases in 2020, to 135,000 cases last year. Outside of flavored releases, Diageo scored another Hot Prospects award for the primarily aged brand Ron Zacapa. The Guatemalan rum reached 66,000 cases last year and earned its first award. “The aged rum category is just scratching the surface, and we expect it to keep growing,” says Zacapa senior brand manager Dina Krannich. “With the increased interest in luxury goods, elevated aged rum brands like Zacapa are primed to captivate new consumers willing to spend more for a better sipping experience.”

While Captain Morgan landed the largest flavored rum on this year’s list, Pernod Ricard’s Malibu Watermelon also made the grade. The brand reached 88,000 cases last year, after depleting fewer than 500 cases in 2020. Hot on their heels is Sovereign Brands’ Bumbu. The Barbados-distilled rum was explosive in 2021, rocketing nearly 81% to 130,000 cases. Since 2018, Bumbu has averaged 76% growth each year. Pernod took a stake in Sovereign last year, further elevating the company’s ambitions. “My opinion is that you need a brand to catapult certain categories,” Sovereign CEO Brett Berish told Impact. “Patrón did that for Tequila. I think Grey Goose did that for vodka, and Hendrick’s has done that for gin. And I think Bumbu is already doing that in the rum category.” The final rum brand on the Hot Prospects list is Spirit of Gallo’s Diplomático, which rose 34.1% to 55,000 cases.

Although aged and brown spirits make up the majority of this year’s Hot Prospects winners, unaged white spirits like vodka and gin also made a strong showing. Bacardi’s Grey Goose Essences is the largest vodka on the list at 149,000 cases. The offshoot earned Hot Prospect status in its second year on the market when it added 125,000 cases. Though quite a bit smaller than Bacardi’s flavored vodka, Diageo landed on the list this year with Cîroc Summer Citrus, a limited release. In its debut year, the Cîroc flavor reached 75,000 cases. Pernod Ricard has also found success with a new flavored release, with Absolut Watermelon earning the nod by reaching 64,000 cases in its debut last year. The remaining three vodka winners are all distilled in the U.S. The largest, Sazerac’s Wheatley, reached 110,000 cases last year, more than quadrupling in size compared to 2020. Behind Wheatley, 21st Century Spirits’ Blue Ice also made a strong showing, up 23.4% and nearly reaching 100,000 cases for the first time. Finally, Tahoe Spirits’ namesake vodka also earned a Hot Prospects award, growing 32.5% to 53,000 cases.

In gin, Diageo’s Aviation was on top, crossing the 100,000-case mark for the first time. The American brand, partly owned by actor Ryan Reynolds, grew 17.5% last year. The second largest gin brand, Ireland’s Drumshanbo Gunpowder—a Palm Bay International label—grew 39% in 2021, reaching 73,000 cases. French gin is represented on this year’s list by Maison Ferrand’s Citadelle. At 69,000 cases in 2021, the brand has posted steady growth since 2018 when it was at just 39,000 cases. The international showcase continues with Azzurre Spirits’ Empress 1908, a Canadian gin. Last year, Empress grew to 69,000 cases, tying Citadelle. Though both brands have posted strong growth, Empress 1908 has doubled each year since 2019. Milestone Brands recently gained Empress 1908 by acquiring Azzurre parent company Victoria Distillers for an undisclosed sum. Milestone CEO Eric Dopkins, who served as Deep Eddy vodka CEO before that brand’s acquisition by Heaven Hill in 2015, says Empress 1908 is a “differentiated innovation in the super-premium spirits category.”

The final two gin brands come from Scotland and Japan. Rémy Cointreau’s Scottish brand the Botanist is the larger of the two at 63,000 cases. It earned its first Hot Prospects award for its 31.5% jump in 2021, and followed up by advertising during the Super Bowl this year. Beam Suntory’s Roku also earned its first award for its 2021 growth; last year, the brand grew 34.1% to 51,000 cases. Outside of this year’s biggest categories, liqueurs, mezcals, and one Cognac earned Hot Brand honors, too. Zamora Co. USA’s Licor 43, at 95,000 cases is the largest liqueur, and is followed by Brown-Forman’s Chambord, Beam Suntory’s Midori, and Luxco’s Brady’s Irish Cream. Ilegal’s namesake mezcal and CNI Brands’ Banhez represent agave spirits beyond Tequila on this year’s list. Ilegal was at 94,000 cases in 2021, after nearly doubling in size through the year. Banhez, meanwhile, grew to 55,000 cases, up nearly 50%. Finally, the lone Cognac to earn a Hot Prospects honor for its 2021 growth is Beam Suntory’s Courvoisier VSOP, which leapt 23.2% to 51,000 cases.

Domestic Wine: Golden State Rules

Turnover is the theme of the Hot Prospects domestic wine list, with 13 new arrivals and 21 departed brands (including four that graduated to “Hot Brands” status) making for a total of 23 awardees this year. Only two states are represented—along with California’s perpetual dominance, four labels from Washington State qualified, including the top label overall. The brands qualifying as Hot Prospects have only accelerated in recent years, advancing all together from just over half a million cases in 2018 to 2.8 million in 2021, as growth rates climbed from 50% in 2019 to 78% last year. The top domestic Hot Prospect was newcomer Top Box, produced by Ste. Michelle Wine Estates. The Washington brand has maintained extremely strong growth over the last two years following its introduction in 2019. From a base of 29,000 cases in its launch year, Top Box soared to 133,000 in 2020. It matched that growth again last year, adding another 107,000 cases to reach 240,000 cases. With options including Chardonnay, Red Blend, and Cabernet Sauvignon Rosé, the boxed wine brand retails for around $20 a 3-liter. Also from Ste. Michelle was another new addition to the list called Liquid Light. Like Top Box, it launched in 2019. The brand is part of the growing trend toward low-calorie options and boasts that a 5-ounce glass of its Washington Sauvignon Blanc and Rosé contain 95 calories. It’s part of Ste. Michelle’s Elicit Wine Project innovation and incubation program. Last year it grew to 51,000 cases on 52% growth.

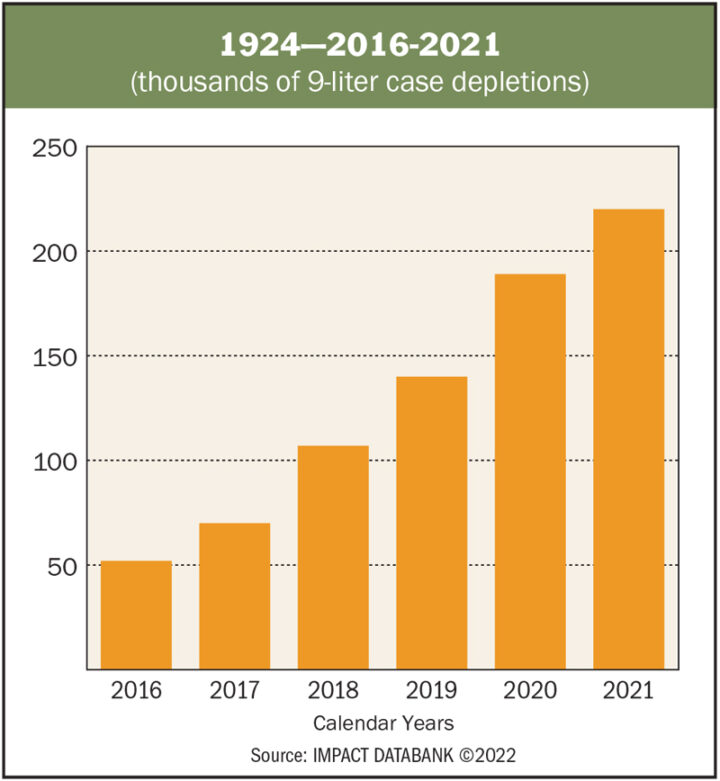

Delicato Family Wines fielded two honorees as well, led by 1924. Named for the year the Indelicato family first planted vineyards in Manteca, California, 1924’s lineup includes Double Black Bourbon Barrel Aged Cabernet Sauvignon, Double Black Red Blend, and Double Gold Sauvignon Blanc, among others. The California-produced label sources from multiple regions including Lodi. It grew 16% last year to reach 220,000 cases. Delicato’s other Hot Prospect is Three Finger Jack, another returning California label that grew 60% last year to reach 80,000 cases.

Bogle Vineyards & Winery’s Juggernaut brand has lived up to its name as it made the Hot Prospects list again, reaching 210,000 cases on 33% growth in 2021. The California brand features two offerings: Russian River Pinot Noir and Hillside Cabernet Sauvignon, which both retail for $20 a bottle and feature striking label art depicting attacking lions and hawks. The other two Washington State wines to qualify were Substance and Browne Family Vineyards. Substance, from acclaimed winemaker Charles Smith’s House of Smith, started with a Cabernet Sauvignon in 2015. The brand features minimalist, periodic tablestyle labeling, as if the wine varietals were chemical elements. The brand’s growth improved 24% last year as it reached 174,000 cases. Browne Family Vineyards, meanwhile, is produced by Precept Wines and rose to 79,000 cases on 15% growth in 2021.

Elsewhere in California, Constellation Brands’ Unshackled, a spinoff of The Prisoner, continued to excel. The Prisoner itself has achieved volume to qualify as a Hot Brand. The Unshackled line features four varietals: Chardonnay, Cabernet Sauvignon, Red Blend, and Sauvignon Blanc. It was up 30% last year to 139,000 cases. The brand is sponsoring a contest called The Great Unshackling, which promises to give the winner $75,000 to escape their daily grind and pursue their dream job. O’Neill Vintners & Distillers’ Harken brand returned to the list on 18% growth to reach 97,000 cases.

The Wine Group scored the most nods of any company with five Hot Prospects in its stable. Its top performer was Franzia Refreshers, which rocketed out of the gate to 220,000 cases in its debut year last year. Similar to Liquid Light, it’s a low-calorie drink, boasting 90 calories a 5-ounce glass and a milder 6.5% abv. Winemakers Selection, in its second year on the market, gained 48% to reach 155,000 cases. Tribute also had a stellar year, joining the Hot Prospects after adding 75,000 cases to go from 27,000 cases in 2020 to 102,000 cases in 2021. Silver Gate, from a smaller base, quadrupled its 2020 volume to reach 52,000 cases, and Sun Pop garnered 50,000 cases in its launch year.

Meanwhile, Vintage Wine Estates saw improving fortune for its Bar Dog brand. It joined the list as growth accelerated to 46.5% last year to bring it to 95,000 cases. Likewise, Foley Family Wines’ label Banshee pushed past 50% growth to reach 87,000 cases. Fetzer Vineyards was honored for Quarter Cut, which reached 53,000 cases on 25% growth in its third year on the market. Treasury Wine Estates (TWE) fielded two California brands as well. The first is 19 Crimes Snoop Cali Rosé, part of the Snoop Doggrepped spinoff line of Australian import 19 Crimes. It follows Snoop Cali Red and surpassed 200,000 cases on launch, speaking to the strength and name recognition of the partnership. TWE also found success with St. Hubert’s The Stag, which has steadily risen and reached 64,000 cases on 32% growth last year. Additionally, Folio’s Oberon Cabernet Sauvignon rose to 109,000 cases on 25% growth and McBride Sisters Wine Co. saw its brand Black Girl Magic take off to 60,000 cases in its second year. Sunny With a Chance of Flowers, from Scheid Vineyards, gained fivefold to hit 58,000 cases in its second year, and Purple Wine + Spirits’ Raeburn rose to 181,000 cases on 32% growth.

Imported Wine: Diversity Reigns

Seventeen up and coming brands from the imported wine category earned Hot Prospect honors last year, with the vast majority hailing from the premium-and-above segment. Italy has been a reliable reservoir of Hot Prospect winners in recent years, and it remains well-represented with three entries, but overall this year’s roster showcases impressive balance. In addition to the three winners from the boot, France accounted for three Hot Prospects this year (plus a share of the Avaline brand, which counts French, Spanish, and domestic wines in its range), while Argentina and New Zealand placed two brands each, and Spain, Portugal, Chile, Australia, and Japan were all represented with a brand apiece.

Two of Italy’s three Hot Prospect wines this year—La Gioiosa and Cantina Lavis—come from the portfolio of Miami-based importer Ethica Wines. La Gioiosa Prosecco is among the fastest-growing brands in Ethica’s 800,000-case portfolio, and a key reason the company is projecting sales of $90 million this year, with 80% of the business centered in the U.S. Portfoliomate Cantina Lavis, a cooperative of 800 growers, is located in Trento. Roughly 80% of its production is in white wines like Chardonnay, Pinot Grigio, and Müller Thurgau, but it also includes native red varieties like Schiava, Pinot Nero, Merlot, Teroldego, and Lagrein. Ethica also recently added Barolo producer Casa E. Di Mirafiore, owned by Eataly founder Oscar Farinetti, to its U.S. and Canada portfolio. The other Italian brand on the list is Cupcake Sparkling Rosé. The sparkling wine’s strong performance boosted Cupcake’s total U.S. volume to 2.9 million cases in the U.S. in 2021.

The European contingent also counts a number of brands from France and Spain, including the largest Hot Prospect imported wine, Campo Viejo Cava, part of the Pernod Ricard range. While Cava has been overshadowed by Prosecco in the U.S., it grew faster last year, albeit from a smaller base. Organically made wines were a key factor in Cava’s gains last year, as nearly 10% of all Cava produced was organic. More than 9% of Cava volume in the U.S. is classified as Guarda Superior, according to Impact Databank, and current regulations stipulate that all Guarda Superior Cava be 100% organic by 2025.

Avaline, from Cameron Diaz and Katherine Power, is also focused on organic wines and includes a Spanish sparkler in its lineup, as well as a growing number of other bottlings from France and the U.S. Earlier this year, Avaline debuted its white and rosé wines in 4-packs of 250-ml. cans ($22). Another label rising fast in the rosé segment is Aix from Kobrand. With 185 acres of vineyards, Maison Saint Aix is one of the largest domaines in the AOP Coteaux d’Aix-en- Provence. Its namesake brand updated its packaging last year and the move paid off with robust 162% growth to 55,000 cases.

Château d’Esclans, maker of Whispering Angel rosé, earned a Hot Prospect award for The Beach, a rebrand of the winery’s entry-level rosé, previously known as The Palm. The rebranded wine is still sourced from the south of France and made from Grenache, Cinsault, and Syrah. The Beach comes with a focus on sustainability, featuring lighter glass and making its debut with a partnership with the Surfrider Foundation, an ocean preservation-focused non-profit. The Beach, like The Palm before it, is aimed at Millennial and Generation Z consumers entering the rosé category. “There are many new rosé brands and Whispering Angel’s become a little bit more expensive as well,” says Paul Chevalier, vice president for Château d’Esclans at Moët Hennessy USA. “So we said we need a wine specifically for this generation.”

Champagne Laurent-Perrier is at the top of the ladder pricewise among Hot Prospects. The brand has doubled in size compared with just three years ago, and has been promoting Laurent-Perrier Cuvée Rosé as the quintessentially French pink Champagne in a bid to differentiate itself, while continuing to cultivate interest at the top end with prestige cuvée Grand Siècle. Overall, Laurent-Perrier is the third-largest Champagne brand in the U.S. in volume terms, behind only Veuve Clicquot and Moët & Chandon. Silk & Spice, from Portugal, likewise made the grade. Silk & Spice is one of the anchors of Connecticut-based Evaton Inc., the U.S. subsidiary of Portugal’s Sogrape. Launched in 2017, Silk & Spice has rapidly gained traction marketed as a Portuguese red blend. Evaton’s range also includes Sandeman Port, Ferreira Port, and Casa Ferreirinha, as well as Kylie Minogue Wines and Il Palagio, the Tuscan estate owned by Sting and Trudie Styler.

The Southern Hemisphere has no shortage of Hot Prospect wines this year, the largest being Franzia Bold & Jammy from The Wine Group. Sourced from Chile, Bold & Jammy reached 145,000 cases in its second year on the market, helping to drive growth for Franzia, which has also seen gains for wines like Rich & Buttery Chardonnay and Dark Red, as well as from its Pinot Grigio and Pinot Noir labels. Argentina boasts two Hot Prospect entries, both from Origins Organic Imports. Origins Organic, based in Miami, is led by CEO Labid al Ameri and co-owner Anne Bousquet. Bousquet and Ameri are also co-owners of Domaine Bousquet. With affiliated offices in Bordeaux, Argentina, and Brazil, the company accounts for annual sales of more than 750,000 cases globally. The Domaine Bousquet brand reached 115,000 cases on 15% growth last year. Portfoliomate Natural Origins is a boxed wine label that’s gotten off to a fast start, hitting the 100,000-case mark after debuting in 2020.

New Zealand, a key driver of imported wine’s growth in the U.S. lately, also saw two brands earn honors. Giesen has been propelling growth for marketer Pacific Highway Wines. “The Giesen business continues to grow quite rapidly, and to do that with a really short vintage in 2021 was very challenging,” says Pacific Highway president Mark Giordano. “On the 0% alcohol side of the brand, we launched with a Sauvignon Blanc and did 15,000 cases the first year. In March we launched a rosé, and now we’re launching a red blend and Pinot Grigio. Our target for that business is around 50,000 cases over the next year, and I think Giesen in general has a lot of room to grow.” Giesen is joined by Kim Crawford Illuminate, a lower-calorie offshoot of the core brand that debuted in 2020.

From Down Under, Yellow Tail Pure Bright is another Hot Prospect targeted at the expanding “better-for-you” wine segment. The Fun Wine Co. earned a Hot Prospect for its namesake brand, which has also grown into a player in the betterfor-you wine category. Fun Wine is aligned with Republic National Distributing Co. across the distributor’s 37-state plus D.C. footprint. The Fun Wine Co.’s portfolio includes a Hard Bubbly Collection with Strawberry Rosé Moscato, Peach Passion Moscato, Coconut Pineapple Chardonnay, and Sangria; as well as the Café Graffiti Collection, featuring Cappuccino Chardonnay and Espresso Cabernet.

From Japan, Tyku Sake makes an appearance on the Hot Prospects list after enjoying marked growth over the past two years. The brand is part of the Davos Brands range acquired by Diageo in 2020 for up to $610 million.

RTDs Rise To The Fore

A total of 15 brands from across the vibrant RTD landscape earned Hot Prospect awards, with the vast majority hailing from the spirits category, augmented by two wine-based cocktail brands. On the spirits-based side, brands made with Tequila, rum, vodka, and gin are all present, as well as some brands that utilize multiple spirits across their respective portfolios. Tequila seltzer has carved out a growing following among younger drinkers, so it’s little surprise that the category features prominently among Hot Prospect RTDs. The largest brand on the list is Tequila-based Cazadores RTDs from Bacardi USA, which neared 200,000 cases in their first year on the market. This spring, Cazadores added a Ranch Water flavor to the lineup, made with a blend of Cazadores Blanco, sparkling mineral water, and a hint of fresh lime juice. Cazadores Ranch Water weighs in at 5.9% abv and retails at $15 a 4-pack of 12-ounce slim cans. Onda Tequila seltzer is likewise a rising player. Onda is angling for further growth this year after reaching 10,000 accounts across 31 states in 2021. The Tequila seltzer brand, co-founded by actress Shay Mitchell and chaired by industry veteran Jim Clerkin, raised $12.5 million in a new round of funding this summer, receiving backing from Aria Growth Partners and spirits investor Clayton Christopher, alongside other investors including fashion retailer Revolve, and unnamed celebrities. “We are up well over 100% in volume throughout the U.S. and up more than 200% in many of our top focus markets off of a strong six-figure depletions base,” co-founder and CEO Noah Gray told Impact. Tequila heavyweight Proximo Spirits is also in the ring with Playamar Seltzer, which hit 100,000 cases last year. From the gin category, Diageo-owned Tanqueray RTDs earned honors, as did Bombay RTDs from Bacardi. The Bacardi contingent also includes Plume & Petal, which markets vodka-based canned cocktails at 4.5% abv in Cucumber Splash, Lemon Drift, and Peach Wave flavors. Constellation-owned Svedka’s vodka RTDs made the grade after adding 100,000 cases in volume to their total last year, and, from the rum segment, Pernod Ricard’s Malibu Cocktails also charted impressive gains. Fishers Island Lemonade, retailing in the range of $16-$20 a 4-pack of 12-ounce cans, was an early entrant in the premium spirit-based RTD category, launching in 2013. The original lemonade is a canned version of a popular cocktail made with Bourbon, vodka, honey, and lemon, originally served at founder and CEO Bronya Shillo’s family bar, the Pequot Inn, on Fishers Island, New York.

Among the brands using a variety of spirits bases is Galloowned Liqs. The Liqs portfolio includes spirit-based Vodka Kamikaze, Vodka Lemon Drop, Vodka Lychee Grapefruit, Whiskey Fireshot, and Tequila Cinnamon Orange shots, while its winebased shot flavors include Margarita, Lemon Drop, and Kamikaze. The brand’s shots retail at $10 a 4-pack. Liqs also markets premixed cocktails in a 1.5-liter format, including Margarita, Strawberry Margarita, and Mojito. Another is Twisted Shotz from Independence Distillers USA, part of Asahi. Twisted Shotz come in a double-chambered, reusable shot glass and include flavors like Jolli Jolli, Pussy Cat, Pineapple Upside Down Cake, and Island Thunder. They were joined last year by wine-based Twisted Whipz, which have an abv of 14% and retail at $19 a 15-pack. Fellow Hot Prospect Biggies Buzzballz is a 15% abv, 1.75-liter brand with a range including Chocolate Tease, Tequila Rita, and Strawberry Rita. Chicago-based Zing Zang is best known as a mixer company with volume of 2 million cases, but in 2020 it launched an RTD range, and has been rewarded with solid growth for offerings including Bloody Mary, Margarita, and Bourbon Whiskey Sour expressions. The RTDs are at 9% abv and retail at $13 a 4-pack of 12-ounce slim cans. Two wine-based RTD labels also won Hot Prospect awards: Flybird from Don Sebastiani & Sons, known for its Margarita-centric portfolio, and Soleil Mimosa from Lescombes Family Vineyards, which is poised to cross the 100,000-case mark this year.