Prav Saraff, the director of operations at 1 West Dupont Circle Wines and Liquors in Washington, D.C, believes the industry’s future has already arrived. “The ease of being able to restock liquor cabinets and wine cellars and to order the necessities for a party from the comfort of a cellphone has made it so that people don’t feel the need to go into the store anymore,” he says, adding that because of social distancing measures, many consumers don’t want to walk into a store to make a purchase.

For Saraff and other beverage alcohol retailers, the emergence of on-demand delivery has resulted in added sales, while consumers have quickly become enamored by the convenience and reduced-friction transactions the services offer. Still, some retailers are becoming increasingly leery of app-based delivery platforms via third-party providers, citing the high fees and increased overhead associated with the programs, pressure to deliver orders in a short period of time, and the inability to promote their businesses as they see fit on the apps. Their own delivery programs are the preferred option, several retailers say.

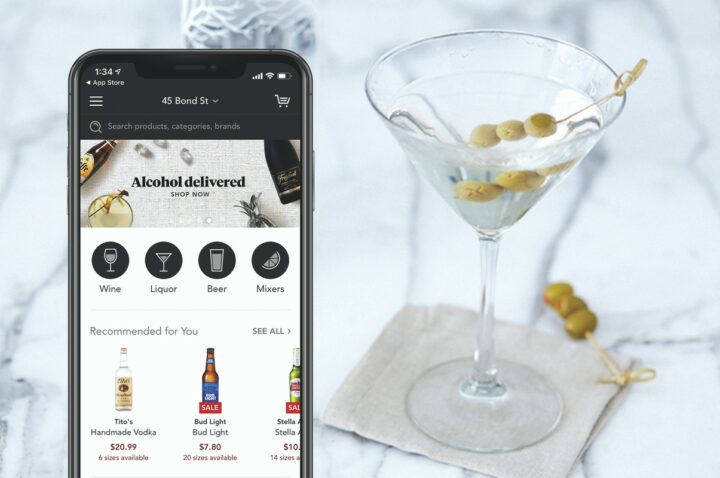

While regulations vary, most states allow some form of online beverage alcohol sales and delivery, either via store employees or third-party providers. As with other trade channels, the Covid-19 pandemic has greatly accelerated consumer demand for online ordering and delivery of products carried by liquor stores, and many expect the surge to continue after the pandemic. Boston-based Drizly, which provides a platform for on-demand delivery, estimates that less than 2% of beverage alcohol purchases were made online in 2019, but in the past year, the figure has jumped to as high as 5%. Drizly’s earnings tripled in 2020, the company says. “We help mom-and-pop retailers move into the 21st century by offering a turnkey e-commerce service,” says Lindsey Andrews, CEO and co-founder at New York-based rival Minibar. “But we’ve barely scratched the surface.”

Increased consumer awareness of delivery apps such as Drizly and Minibar—both of which rely upon retail partners or third-party providers to carry out delivery—has driven much of the growth. According to Liz Paquette, head of consumer insights at Drizly, half of the app’s current users didn’t even know beverage alcohol delivery was legal prior to the pandemic. Now that they’re users, they plan to remain loyal to the app, she says. “Consumer expectations that retailers will provide on-demand delivery continues to grow,” she adds.

According to Saraff, Drizly, Minibar, and Instacart were lifesavers for the company and its employees during the pandemic last summer, as 1 West Dupont Circle was closed to walk-in traffic. “They were a large part of our business,” he says. Vinay Patel, president and CEO of the 7-unit Blarney Stone Wine & Spirits chain in Indiana, which partnered with Drizly earlier this year, is also grateful for the additional revenue stream the service provides. “I believe the on-demand delivery piece of our business is going to get bigger every day and will be critical to growing our business,” the retailer remarks. But at Argonaut Wine & Liquor in Denver, Ron Vaughn, co-owner and COO, is taking a wait-and-see approach to the apps’ staying power. Argonaut was the first Colorado retailer to partner with Drizly about seven years ago, and Vaughn says orders have skyrocketed to as high as 250 a day in recent months, requiring a team of 20 drivers and two full-time managers. Still, he’s not sure if high demand will stick after the pandemic. “Time will tell,” he says.

Entry Opportunity

Category sales trends on the delivery apps largely reflect those of the overall beverage alcohol market. Wine remains the biggest category for Minibar, while spirits sales overtook wine last year for Drizly, accounting for 41% of sales. According to Drizly, segments that showed particular strength in 2020 included Bourbon, Tequila, canned RTDs, and liqueurs. In wine, sparkling wine and Champagne emerged as strong performers last year, Paquette says, along with 3-liter boxes. Within beer, meanwhile, hard seltzers accounted for 21% of category sales on Drizly in 2020, with New England IPAs also trending well. Instacart also reports surging sales of hard seltzers, such as White Claw, along with hard kombucha.

Retailers say the biggest benefits to partnering with delivery app providers are the entry they allow into on-demand delivery and the opportunity for increased sales. “They can drastically lower the barriers to entry into this space,” remarks Marques Warren, owner of Seattle’s Downtown Spirits, which first partnered with Drizly in 2014. “Having a technology partner that provides a ‘plug-and-play’ type of shopping cart product democratizes the ability to offer these services for small- and medium-sized businesses.”

According to Saraff, “the biggest benefit is that it brings in incremental income. We look at it as exposure to and orders from people who might not have otherwise ordered from us.” His store processes about 400 orders a week via Drizly, Minibar and Instacart, he says. Vaughn says the opportunity for added business via Drizly’s national platform, as well as its ease of use, are also among the app’s benefits.

Overhead Concerns

But retailers also cite the drawbacks of partnering with outside platforms for sales and delivery orders. Retailers with years of experience with the apps complain about the overhead involved, including contractual fees, labor, vehicle and insurance costs. “We do all the work and cover the cost of delivery, and they still get their 10% cut,” says Adithya Bathena, owner and president of Super Buy-Rite in Jersey City, New Jersey, which partners with both Drizly and Minibar. For Vaughn, ensuring delivery to customers in one hour can be a challenge in a market like Denver, particularly when bad weather hits. “But customer ratings include delivery time and those retailers that deliver under one hour receive higher ratings,” he laments.

Saraff notes that the lack of interaction with customers is a downside to the apps. “We’re known for our customer service,” he says. “When someone orders from an app, we don’t get a chance to offer the experience to them fully. We can’t make wine or cocktail ingredient recommendations. The customers end up ordering just the brands they’re familiar with or have seen an advertisement for.”

Indeed, some leading retailers say that moving forward they see more value in focusing on their own store delivery programs than those of third parties. Bathena, Warren, and Vaughn all note that they’ll place a bigger emphasis on their own stores’ e-commerce sites, including store delivery. “Having our own brand at the forefront is the most important area for us to focus on in the coming year,” says Warren.

Whether it’s via retailers’ own sites or those of on-demand apps, the e-commerce and delivery space is expected to continue its strong growth. Drizly forecasts that online beverage alcohol sales could account for as much as 20% of industry sales in 5 years. Retailers like Saraff are ready for the shift. “The future will look very different,” he says. “Retailers must either be thinking of or preparing for tomorrow or they’ll get left in the dust.”