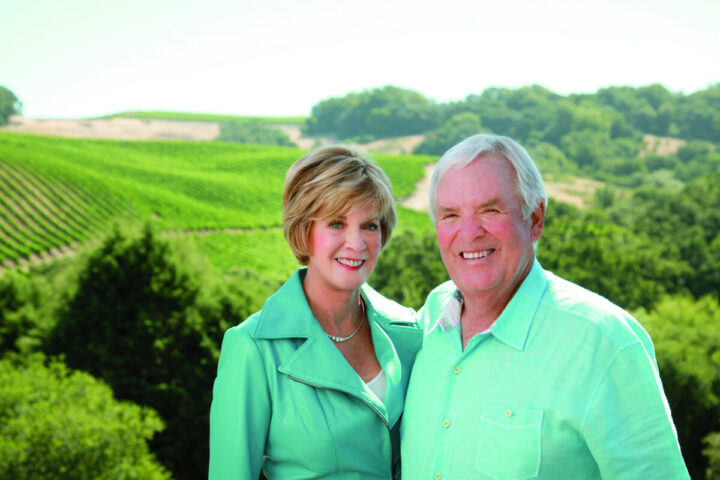

There are many family businesses in the wine world, but few are like Foley Family Wines. It all started when Bill Foley and his wife, Carol, bought a property in Santa Barbara County, California in 1996. Less than two decades later, this once-modest bit of dabbling in wine has become a company with more than 20 prestige wineries and vineyard properties, including well-known labels like Chalk Hill Estate, Chalone, Silverado, Sebastiani, and Ferrari-Carano, as well as properties in the Pacific Northwest and New Zealand. The years have been marked by a whirlwind of wine deals.

“I’m known as a serial acquirer,” says Foley, adding that he’s been fortunate to purchase wineries and vineyards staffed with excellent people. The results appear to support such praise: According to Impact Databank, the majority of Foley Family Wines’ leading brands posted notable increases in 2022. Ferrari-Carano, which was purchased by Foley in 2020, now makes up more than a quarter of the company’s total volume, boasting gains of 8.3% last year to reach 464,000 9-liter cases. At No. 2, Chalk Hill advanced 31% to 183,000 cases. Six other leading Foley brands—Sebastiani, Banshee, Rickshaw, The Four Graces, Silverado, and Firestone—also posted double-digit gains in 2022. In fact, only one brand among Foley’s 12 largest-selling wines, Chateau St. Jean, was estimated to have declined last year, according to Impact Databank. Foley has also shown a willingness to invest in improving these properties—and that has been a big factor in the company’s success.

“Chalk Hill was a fantastic acquisition,” Foley says, highlighting the winery’s estate, vineyards, and tasting room, which Foley rebuilt when he bought the brand in 2010. “We improved everything—we rebuilt the tasting room and the winery itself, and we replanted everything on the property. The wines speak for themselves.” Similarly, Foley is equally proud of the Ferrari-Carano acquisition—as it’s now the company’s largest wine brand—and his recent purchases of Sonoma’s Chateau St. Jean and Napa’s Silverado Vineyards, which both joined the Foley fold within the last 14 months.

Company president Shawn Schiffer adds that Foley Family Wines will likely continue its acquisition streak. “Our founder built the company via acquisitions, and we continue to evaluate acquisition opportunities that make sense,” Schiffer says. “Assimilating three major acquisitions into our portfolio in the space of two years has given our team the confidence that we can evaluate and execute these opportunities.”

Expanding The Portfolio

While some companies retrenched during the Covid-19 pandemic, Foley adopted the opposite strategy. The company’s most recent acquisition tear started in June 2020, when Foley bought Ferrari-Carano in Sonoma County, adding major volume to his business in a portfolio of wines priced at $15 or higher a 750-ml. Six months later, the company acquired Kenwood, California-based Chateau St. Jean. Most recently, in July 2022, it acquired Silverado Vineyards, a leading producer of luxury wines from estate vineyards across four Napa Valley appellations.

Those three purchases brought Foley Family Wines’ volume up to nearly 1.9 million cases in 2022, according to Impact Databank estimates, bringing the company closer to Foley’s stated goal of reaching 2 million cases. More importantly, the acquisitions further cement Foley Family Wines in the super-premium and luxury wine space. “We’re in premiumization mode now, and have moved away from some of the less expensive wines we were formerly involved with,” Foley explains. “At this point, more than 90% of our wines sell for more than $15 a bottle. Some are sold for $300 a bottle or more.”

Even in an uncertain economy, Schiffer adds the company’s positioning in the super-premium wine space is in line with what consumers want. “From a price point perspective, wines priced above $11, and even above $15 and higher, are still doing pretty well,” he says. “Our portfolio in the higher price points has kept us pretty insulated from some of the impacts of the economic downturn.”

Starting In Santa Barbara

Bill and Carol Foley launched Foley Family Wines in 1996 when they purchased 1,000 acres in the then-relatively unknown Sta. Rita Hills region in Santa Barbara County, California. They launched Lincourt Vineyards—named for their two daughters, Lindsey and Courtney—early on and focused on producing Chardonnay and Pinot Noir. Two years later, in 1998, the company added Foley Estates in Sta. Rita Hills, which also emphasized Chardonnay and Pinot Noir.

For nearly a decade after that, the Foleys focused entirely on those two brands. But in 2007 the acquisitions began in earnest, as did the company’s geographic expansion. That year, Foley Family Wines purchased Firestone Vineyard in the Santa Ynez Valley and Merus in Napa Valley. In subsequent years it added Sebastiani Vineyards & Winery, Chalk Hill Estate, and Banshee in Sonoma County; Chalone Vineyard in Monterey; Acrobat in Oregon; and Three Rivers Winery in Washington, among several others in California and the Pacific Northwest. The company has also branched out over- seas, and now owns and imports several labels from New Zealand. All told, the company’s portfolio spans 28 wineries. In addition, Foley Family Wines is the importer and market- ing agent for Lucien Albrecht from France and Nieto Senet- iner from Argentina.

“We started out with Lincourt and Foley Estates, and I real- ized we would never get attention being that small,” Foley recalls. “So we acquired Firestone in Santa Barbara County and I thought, ‘Okay, now we’ve got it. We’ll be important to distributors and they’ll pay attention to us.’ But actually, we still weren’t big enough. So I transitioned and we came to Northern California and invested in Sonoma and Napa.” On his geographic expansion outside California, Foley says there was always a strategy. “We started buying wineries in Oregon and Washington, and we have a series of wineries in New Zealand in every appellation that matters,” Foley says. Indeed, his New Zealand wine holdings are significant and are primarily focused on Sauvignon Blanc, Pinot Grigio, and Pinot Noir from the country. “When I was buying these properties, some people said, ‘Oh, he’s just buying this or that just to buy it.’ But there was always a plan.”

Going forward, Schiffer says the company is always looking for acquisitions. “The economic situation is going to put pressure on some producers who may have been holding on or moderately stable with a decent economy,” he says. “Now into year three, between the pandemic and other geopolitical issues that have hurt the economy, maybe some of these folks will decide that 2023 is the right time to exit their business.” This would benefit Foley, the acquirer.

Any new acquisition will likely be on the west coast, Schiffer adds, so the company can leverage current assets. He notes that Foley Family Wines assesses opportunities on three fronts—how a potential wine will fit into the existing portfolio or add a new category or varietal into the business, how it would help the company from an operations and production standpoint, and how its facilities can relate to consumers. For the last point, Schiffer stresses that Foley Family Wines prefers properties that have a tasting room to attract visitors, and also likes wineries with their own wine club and direct-to-consumer elements to draw prospective buyers in.

Top of mind is expansion of the company’s play in sparkling wines. “We’ve launched a sparkler under the Banshee brand, which is doing very nicely for us, but we want to try to make a bigger play in that space,” Schiffer adds. “We’re looking at whether we develop that capacity organically, or we go out and buy it, or we co-pack with a sparkling producer.” The prospect of a new sparkling wine from one of Foley Family Wines’ prestige producers, like Chalk Hill or Ferrari-Carano, would provide a big boost to Foley’s business, he notes.

Interacting With Consumers

Experiential opportunities are a crucial part of Foley Family Wines. The company has invested heavily in its tasting rooms and winery experiences, and while Schiffer notes a downturn in overall tasting room traffic in recent months, he adds that visitor counts at the company’s higher-end properties remain strong. “We’ve had some cooler weather in Northern California and some rain, and I think uncertainty about the economy has cut down on traffic,” he says. “Ironically, some of our higher-tier guest experiences still do extremely well—we have a brunch at Ferrari-Carano that sells out every weekend. There is demand from that level of consumer.”

On-premise, Schiffer says sales are booming again, and Foley’s brands are benefiting from strong name recognition. He notes that the same phenomenon happened off-premise during the height of the pandemic, when consumers pulled back spending and chose to stay with brands they trusted. “In the on-premise, that’s happened to a degree with wine lists and by-the-glass programs,” Schiffer adds.

The direct-to-consumer channel has also been garnering interest for Foley Family brands, and this includes not only e-commerce sales but also sales through the company’s wine clubs and programs that piggyback onto other Foley-owned business ventures. The Foley Food & Wine Society offers programming geared toward higher-end consumers across a range of platforms and has been well received. People who join the society get access to Foley wines and invites to exclusive wine events, tastings, and culinary programs, but they can also gain access to Foley’s other holdings across hospitality and resort properties, private golf clubs, and professional sports and entertainment experiences.

“The Foley Food & Wine Society is our loyalty program, but it’s much more than that,” says Liz Lease-McCaffrey, senior vice president of consumer direct and tasting rooms at Foley Family Wines. “It was established by the Foley family to celebrate life’s great experiences: wine, food, sports, and the community of sharing those passions.” Foley created Foley Entertainment Group in 2021 to manage his lifestyle and entertainment holdings. Today, through that business, Foley owns the Hotel Californian and its Blackbird restaurant in Santa Barbara, California; the Hotel Les Mars and its Chalkboard restaurant in Healdsburg, California; the ski destination Whitefish Mountain Resort in Whitefish, Montana; and the Black Walnut Inn & Vineyard in Dundee, Oregon. In addition, he’s chairman, CEO, and governor of the National Hockey League’s Las Vegas Golden Knights team and he recently bought the English Premier League soccer team the AFC Bournemouth Cherries. Foley also has ownership stakes in the Henderson Silver Knights—a team in the American Hockey League development program— and the Indoor Football League’s Vegas Knight Hawks. All of those sports ventures fall under the Foley Entertainment Group umbrella, too. Beyond this, Foley is executive chairman of the board of directors for Fidelity National Financial and vice chairman of the board of directors for Fidelity National Information Services.

“Over the last ten years or so, I’ve transitioned from being involved with public companies to focusing on our families’ private investments,” Foley says. “That’s anchored by our wine business, but also other hospitality assets, such as hotels, restaurants, and professional sports teams.”

Foley adds that his various business holdings across wine, hospitality, and sports all complement each other. “It gives us a chance to cross-market, cross-promote, and tie it all together with our Foley Food & Wine Society loyalty program,” he explains. “The goal is for people to earn points when they buy wine, and then use those points to stay at a hotel, attend a hockey game, buy more wine, or enjoy other exclusive experiences. I don’t see anyone else in the industry right now that ties hospitality assets with their wine business the way we do.”

He adds that there’s an inner circle of season ticket holders to his sports teams’ games who also buy a substantial amount of Foley Family wines, and that selective group is invited to Foley wineries and hospitality properties throughout the year. “We’re still building the Foley Food & Wine Society, but if we can tie everything together successfully, we have a successful business,” Foley says.

Family Affair

Between his myriad wine holdings and his ventures beyond the beverage industry, Foley is a busy man. A graduate of the U.S. Military Academy at West Point and a former captain in the Air Force, Foley says there’s still a lot he wants to accomplish and he has no plans to slow down. “I’m still very involved as the owner and, of course, in our acquisitions,” Foley says of his Foley Family Wines business. “If you buy the right properties and hire the right people and let them make wine in the style you want, then you can make really great wine. And that’s what we’ve done in all the properties we’ve acquired. I want the company to keep getting better, more than simply getting bigger. My goal is to leave a legacy for my family.”

Family is important to Foley, and he has three children currently involved in Foley Family Wines. His daughter Courtney is a second-generation vintner for the company, having previously worked in sales, production, winemaking, and distribution. Currently she focuses on ensuring that the company’s sustainability efforts, philanthropy, and production quality, as well as her family’s overall vision, are met, and she also works on communications and the loyalty program. Courtney is sliding into a primary leadership role in the company, noting that she’s involved in a little bit of everything every day. “My family spends a lot of time together, and we spend a good chunk of our time discussing work, how to add value to our portfolio, and how to share that value with employees and consumers of our business,” she says.

Foley’s son Robert is Foley Family Wines’ chief strategy officer and is involved in managing vineyard assets for Foley Family Farms, as well as serving as chief business officer for the Vegas Golden Knights. Daughter Lindsey helps oversee the Foley Family Charitable Foundation. A second son, Patrick, was a winemaker at Foley Johnson Winery, but passed away in 2018.

Going forward, Foley has ambitious plans for the family wine business, including improving his existing wine holdings while also branching out into new winemaking areas. Those will include delving deeper into Oregon Pinot Grigio and Pinot Noir, where he believes Foley Family Wines can do more, and also experimenting in Monterey County, California, and exploring more properties in Napa Valley. Foley is also teasing a spirits project for Foley Family Wines. “We’re going to continue to make everything we have better, but there are a few appellations that we have yet to cover and some where we need to be a little stronger,” Foley says. “We’re also working on two new spirits brands, which we will launch later this year.”

The diversity within the Foley Family Wines portfolio is a point of pride for Courtney, who says that she and her father balance each other out well. “Someone recently said that I was the yin to my dad’s yang, and I have to agree,” she says. “While my dad is more focused on acquisitions and growth, I find joy in building out and providing support for the assets we already have in our portfolio. I like to think my dad starts the sentence with each addition to the portfolio, and I work to finish that same sentence with investment into the aspects of each site that make it special and memorable.”