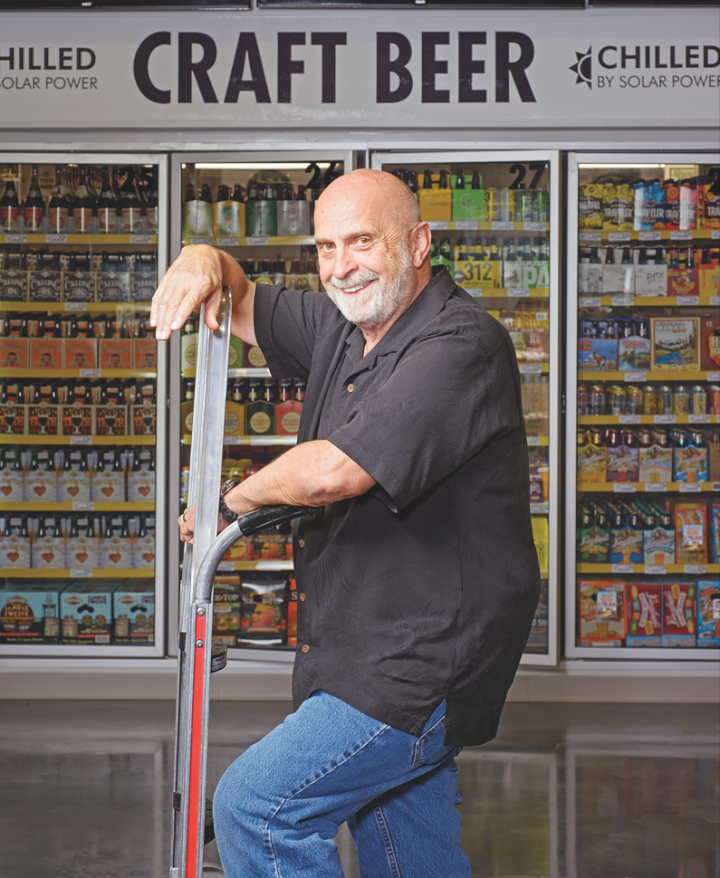

Harry Lukas has built a monument to drinks retailing in the affluent Kansas City suburb of Overland Park, Kansas. Lukas Wine and Spirits Superstore, which opened last October, spans more than 50,000 square feet—ranking it among the biggest stores in the United States. Wine represents a whopping 52 percent of sales, while spirits take 30 percent and beer captures the remaining 18 percent.

The store, located across from its previous 30,000-square-foot space, is one of two Lukas locations in the Kansas City market. He has a second operation just south of downtown on the Missouri side of the border. Lukas is currently expanding that location from 34,000 square feet to 46,000 square feet. Overall, his goal is to create a retailing stronghold around Kansas City—a market in transition since the venerable Berbiglia Wine & Spirits chain downsized sharply over the past year.

“In the Kansas City market, there are Sam’s Club, Walmart and Costco locations, and we compete easily with all of them on price,” Lukas says. “Expanding is the best investment decision I could make. A store like mine will give any competitor pause before deciding to come here.”

Lukas carries nearly 8,500 SKUs, including 4,800 wines, 2,000 spirits and 1,640 beers, and that total is rising as the shelves fill up at the new store. Gross margins for wine run 23 percent to 25 percent on average, while beer and spirits are around 15 percent or less.

The newly opened store has 24-foot ceilings, 35,000 square feet of selling space, 3,000 feet of offices and 15,000 square feet of storage. There’s a 400-square-foot, temperature-controlled fine wine room and similarly sized space for upscale spirits. “With whiskies retailing from $2,000 to $5,000 these days, you have a real merchandising challenge,” Lukas says. “A separate room solves the problem.”

Lukas used to sell $250,000 in Bordeaux futures annually, but the program stalled in the wake of the recession and Bordeaux’s spiraling prices. He now sells more $20 to $30 petits châteaux than classified growths. In total, around 50 percent of wine sales are U.S. labels, while Spain and Italy are prominent on the import side.

Meanwhile, shopping patterns in wine continue to change. “People today read reviews carefully,” Lukas says. “Any wine retailing at over $30 now needs a 90-point rating and a big review. So many wines under $20 have 90-point ratings that it’s hard getting people to spend more.” In 2007, the stores’ wine sales averaged $17 a 750-ml. bottle, and then fell to $12 in 2009. They’ve since rebounded to $15. “The high end is not fully back yet,” Lukas notes.

One thing Lukas doesn’t do is chase after house-brand products. “Put a no-name label on the shelf and you’ve got to hand-sell it,” he explains. “If a national brand gets reviewed well, then we can sell it by the truckload.”